Tejas Networks, which is going for an initial public offering (IPO) shortly, has revealed the telecom equipment company’s revenue, profit, customer details and strategy.

Tejas Networks, which is going for an initial public offering (IPO) shortly, has revealed the telecom equipment company’s revenue, profit, customer details and strategy.

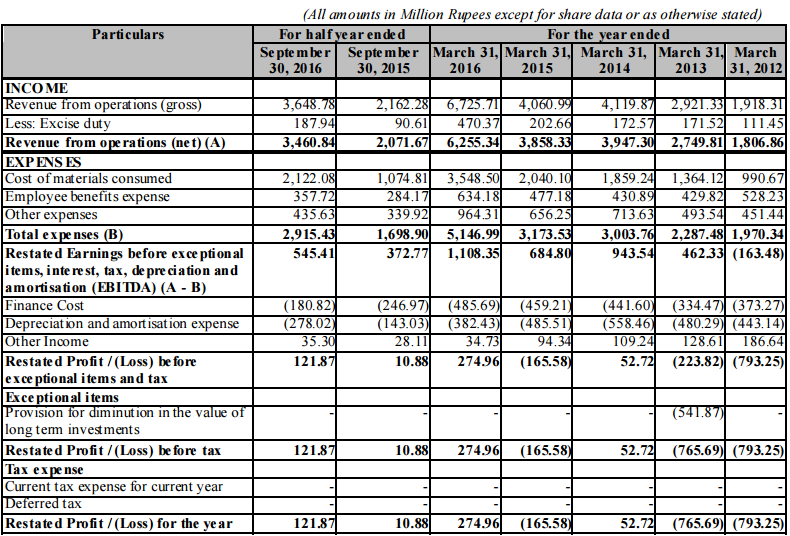

Tejas Networks reported consolidated restated revenues of Rs 6,274.57 million in fiscal 2016 and Rs 3,507.75 million in the first half of fiscal 2017.

The prospects filed with SEBI indicate that Tejas Networks has substantially increased its revenue from international operations.

Tejas Networks generated 43.3 percent revenue from PSU customers in India and 27.9 percent revenue from international customers in fiscal 2016. Tejas Networks’ revenue from PSU customers in India was 27.4 percent of total revenue, while 44.4 percent revenue came from international customers in H1 fiscal 2017.

Research and development

Tejas Networks made investments in research and development, primarily in optical networking products.

Research and development expenses of Tejas Networks amounted to Rs 326.84 million in H1 fiscal 2017 and Rs 644.21 million in fiscal 2016.

Tejas Networks said 53 percent of employees work in research and development functions as of September 30, 2016.

Tejas Networks has developed over 40 carrier-grade equipment, over 300 high-speed PCB and over 250 silicon IPs. The telecom technology filed 326 patent applications including 198 filings in India, 87 filings in the United States and 6 filings in Europe. Tejas Networks received 47 patents.

Market share

Market share

Tejas Networks has the second largest market share in the overall optical networking market during the year ended March 31, 2016, according to Ovum.

Tejas Networks said it is benefiting from optical capital expenditure in India, driven by adoption of smartphones, data usage and several large government initiatives aimed at increasing broadband access in the country.

Indian network operators have under-invested in optical fibre transmission as compared to their peers in China and the United States, due to their initial focus on offering voice services and because of challenges in getting “Right-of-Way” for laying optical fibre in the cities.

Less than 20 percent of cell towers in India are connected on fibre, as compared to 70-80 percent in developed countries, according to Deloitte.

Opportunities

Telecom operators’ growing 3G and 4G networks, use of data among mobile Internetcustomers, low fibre connectivity, poor user experience due to call drops and greater customer churn because the current backhaul technology does not have adequate capacity will propel the revenue of Tejas Networks.

“This is compelling network operators to invest in optical networks, upgrade their network capacities and increase the fibre-connectivity to telecommunications towers, so as to retain and grow their market share,” said Tejas Networks.

Tejas Networks has four sales offices and 15 support centres in India.

Main Indian customers of Tejas Networks include Bharti Airtel, Tata Communications, Aircel and BSNL, Power Grid Corporation of India, RailTel Corporation of India.

Growth Strategy

Tejas Networks has networking products for access, metro and long-haul networks. It aims to invest in research and development and expand product for high growth segments of the optical communications market.

Tejas Networks expects high growth in segments such as 100 Gbps, greater-than 100 Gbps, Optical Transport Network (OTN), Converged Packet Optical (CPO) and Reconfigurable Optical Add-drop Multiplexer (ROADM) in the near future.

CPO Revenues are expected to grow at a CAGR of 7.8 percent from $8.3 billion in 2014 to $12.9 billion by 2020.

The demand for optical switching technologies, ROADM and OTN, is growing at a CAGR of 11.1 percent and 14.6 percent respectively.

The revenue for ROADM is expected to grow from $4.5 billion in 2014 to $8.4 by 2020. The global market for OTN is expected to grow from $3.6 billion in 2014 to $8.2 billion by 2020, according to Ovum.

Tejas Networks will make investments and develop new products such as CPO, PTN and DWDM products with 100 Gbps/200 Gbps/400 Gbps interfaces, CPO and DWDM products with ROADM functionalities and OTN switches.