In a surprising turn of events, the Radio Access Network (RAN) market has witnessed a rapid contraction, marking the swiftest decline in nearly seven years.

The RAN expansion phase that spanned from 2017 to 2021 has now given way to a period of stagnation and decline. While the market’s leveling off in 2022 and the first quarter of 2023 indicated a potential stabilization, the second quarter unveiled a sharp downturn that caught many industry experts off guard.

The RAN expansion phase that spanned from 2017 to 2021 has now given way to a period of stagnation and decline. While the market’s leveling off in 2022 and the first quarter of 2023 indicated a potential stabilization, the second quarter unveiled a sharp downturn that caught many industry experts off guard.

Industry analysts attribute this downturn to a convergence of several critical factors. Stefan Pongratz, Vice President at Dell’Oro Group, remarked, “It is tempting to point the finger at data traffic patterns, 5G monetization challenges, and the odds stacked against an economy struggling with persistent levels of elevated inflation.” These indeed remain pivotal factors in the market’s dynamics, but Pongratz suggests that the decline’s magnitude is due to a cloud of uncertainty emerging from North America.

Complicating matters further, the market’s decline has been exacerbated by an accumulation of excess inventory over the past couple of years. This accumulation was originally intended to mitigate risks in the supply chain but has ended up contributing to the steeper-than-anticipated reversal in the market.

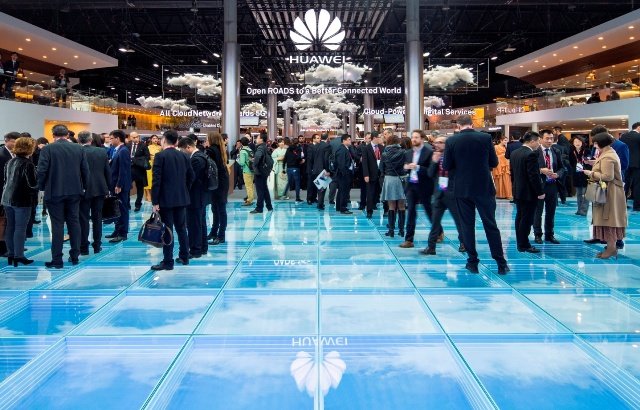

The top players in the RAN sector have experienced varying fortunes amidst this challenging landscape. The leading RAN suppliers for the first half of 2023 include industry giants Huawei, Ericsson, Nokia, ZTE, and Samsung. Notably, Nokia has recorded significant gains in RAN revenue share between 2022 and 1H23, emerging as a standout performer in this tumultuous period.

Huawei, despite grappling with geopolitical challenges, has managed to achieve its highest quarterly RAN share in three years. A noteworthy development is that Huawei’s 2Q23 RAN revenue share outside of North America equaled the combined RAN revenue share of Ericsson and Nokia, indicating its resilience in global markets.

On the other hand, Ericsson and Samsung have seen declines in their RAN revenue shares between 2022 and 1H23, underscoring the intense competition and evolving market dynamics.

Looking ahead, regional projections for the RAN market remain largely unchanged, with revisions made to the short-term outlook. The forecast has been upwardly revised for the Asia-Pacific (APAC) region, excluding China, while the North American region faces a downward revision in its projections.

Given the present circumstances, the consensus among experts is that global RAN revenues are likely to continue their downward trajectory throughout 2023. As the industry navigates through a confluence of challenges, stakeholders are closely watching for signs of a potential rebound or a realignment in market dynamics that could shape the RAN landscape in the coming years.