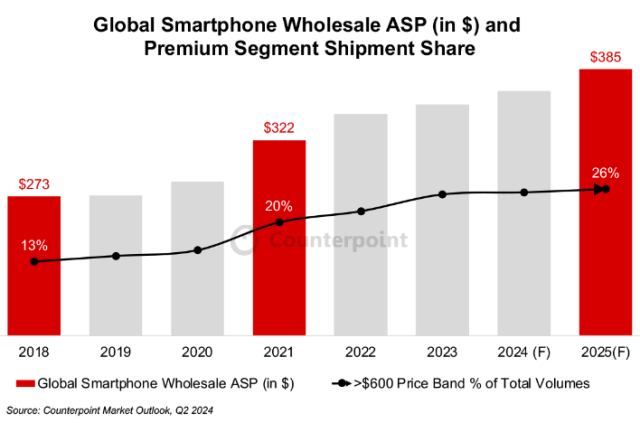

The global average selling price (ASP) of smartphones is anticipated to increase by 3 percent in 2024 to $365, followed by a further 5 percent rise in 2025. This growth is driven by advances in 5G, computing, and a shift toward premium devices, Counterpoint research said.

Generative AI (GenAI) adoption will play a significant role in pushing smartphone prices up in 2025. AI demands more powerful CPUs, NPUs, and GPUs, spurring manufacturers to enhance their premium offerings. In mature markets, AI tech is also being used to encourage upgrades among consumers with longer device replacement cycles.

In H1 2024, smartphone sales above $1,000 grew by 18 percent as phone consumers increasingly sought advanced features. Brands, including Xiaomi, have launched models at higher prices, leveraging the AI trend and powerful chipsets to attract buyers.

Higher bills of materials (BoM), notably due to advanced System on Chips (SoCs) and memory, are impacting smartphone prices. SoC costs are set to rise with the adoption of 4nm and 3nm nodes, affecting both Qualcomm and MediaTek chips. MediaTek’s Dimensity 9400, for example, is priced 20 percent higher than its predecessor due to substantial performance gains.

Advanced SoCs with 4nm and 3nm manufacturing nodes are significantly pricier, as seen in Qualcomm and MediaTek’s new offerings. Notably, MediaTek’s Dimensity 9400 SoC, featuring the NPU 890, Cortex-X925, and Immortalis-G925, demonstrates over 30-40 percent performance improvements across components, but with a 20 percent price hike over its predecessor.

Memory costs also contribute to the ASP rise, as the prices of DRAM and NAND chips are on the upswing, following a new price cycle beginning in Q3 2023. GenAI’s requirements are steering manufacturers towards high-performance memory solutions like LPDDR5x 9600 and NAND UFS 4.0, which come at a premium. This demand for advanced memory solutions, although costly, is essential to support GenAI’s computational needs.

After a previous decline, memory chip prices are on the rise. From Q3 2023 to Q2 2024, DRAM and NAND spot prices grew over 60 percent. High-performance DRAM and NAND, like LPDDR5x and UFS 4.0, are likely to see higher demand due to AI applications. However, demand for high-capacity chips, such as 1TB options, is expected to soften, potentially reducing their prices into 2025.