In the second quarter of 2023, the global wearable devices market experienced a significant rebound in shipments, marking a departure from the preceding two quarters of decline.

According to the data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker, the wearable devices market witnessed an 8.5 percent year-over-year growth, with total shipments reaching 116.3 million devices. This growth, however, impacted the overall market value as average selling prices (ASPs) dipped due to heightened competition and retailer discounting to clear excess inventory.

According to the data from the International Data Corporation (IDC) Worldwide Quarterly Wearable Device Tracker, the wearable devices market witnessed an 8.5 percent year-over-year growth, with total shipments reaching 116.3 million devices. This growth, however, impacted the overall market value as average selling prices (ASPs) dipped due to heightened competition and retailer discounting to clear excess inventory.

The growth surge in the wearable devices market was fueled by increased competition, particularly from smaller companies outside the top 5, enabling them to expand their market share. Notably, this competitive landscape also led to the emergence of lesser-known form factors, such as connected rings.

Jitesh Ubrani, research manager at IDC, stated, “While fitness tracking has appealed to the mainstream audience, consumers now seek a more comprehensive approach to health tracking. Features like sleep monitoring, recovery metrics, readiness scores, and stress level tracking are becoming crucial.”

Smaller brands like Oura, Whoop, and Withings have successfully tapped into this demand, carving a niche for themselves. However, major industry players and local companies are eyeing this space and are expected to launch innovative products in the near future.

IDC’s forecast for 2023 projects a total of 520 million wearables to be shipped, reflecting a 5.6 percent increase from the previous year. Hearables will dominate this year’s shipments, comprising nearly 62 percent of the wearable devices, followed by smartwatches at almost 32 percent. Looking ahead, the market is predicted to expand to 625.4 million by the end of 2027, showcasing a 4.7 percent compound annual growth rate (CAGR).

The size of the Earwear market will reach 381.9 million in 2027 from 320.7 million in 2023.

The size of the Smartwatch market will reach 211.4 million in 2027 from 165.4 million in 2023.

The size of the Wristband market will reach 29.3 million in 2027 from 32 million in 2023.

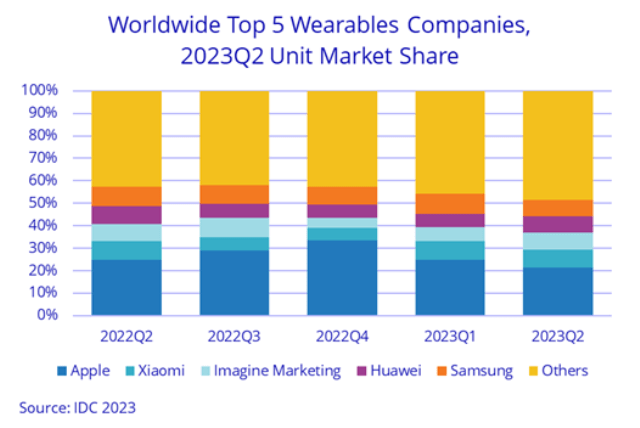

Popular brands like Apple, Samsung, and Fitbit are indeed on the forefront of consumers’ minds when it comes to wearables. However, the growth trajectory is being significantly driven by numerous smaller companies, which, although not globally recognized, are focusing on specific geographies and offering fully-featured devices at competitive prices.

Envisioning these emerging brands gaining global prominence or venturing into untapped markets is entirely plausible, highlighting the immense potential for growth and innovation in the wearable devices industry, Ramon T. Llamas, research director at IDC’s Wearables team, noted.