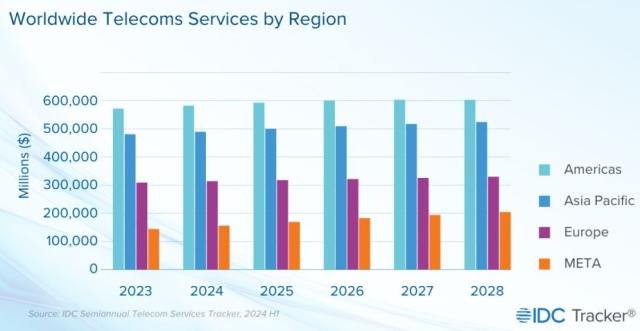

Worldwide spending on telecommunications and pay TV services is forecasted to hit $1,544 billion in 2024, marking a 2.4 percent growth, according to IDC.

The latest Worldwide Semiannual Telecom Services Tracker by International Data Corporation (IDC) said this updated growth forecast represents the highest annual increase in 12 years, with a 1.0 percentage point improvement compared to IDC’s earlier prediction in May 2023.

The optimistic outlook is fueled by strong growth in the Middle East and Africa (MEA) and Latin America. Countries like Turkey, Egypt, Nigeria, and Argentina are witnessing hyperinflation, pushing average revenue per user (ARPU) figures up by over 50 percent annually.

Conversely, forecasts for Europe and Asia-Pacific have been slightly downgraded due to economic slowdowns in major markets like Germany and China. Meanwhile, projections for North America remain steady, with Canada showing minor positive revisions.

Key Segment Trends

Mobile Services: Mobile continues to dominate, driven by surging mobile data usage and machine-to-machine (M2M) applications. These gains are offsetting declines in mobile voice and messaging services.

Fixed Data Services: Growth is sustained by increasing demand for higher bandwidth.

Fixed Voice Services: Spending continues to decline as traditional TDM voice revenues shrink faster than IP voice adoption.

Pay TV Services: A slight decline is expected as video-on-demand (VoD) and over-the-top (OTT) services grow, though traditional pay TV remains a key part of telecom providers’ multi-play offerings.

Challenges and Opportunities

While global connectivity services are expected to grow at a compound annual growth rate (CAGR) of 2.0 percent over the next five years, certain challenges persist. Market saturation in developed regions, political instability in Eastern Europe and the Middle East, and potential policy shifts under the new U.S. government pose risks.

However, improving economic conditions — such as declining inflation and interest rates in the U.S. and Europe — are expected to boost consumer purchasing power.

Telecom operators are encouraged to pursue diversification and innovation to sustain growth. Promising avenues include:

Emerging Technologies: Fiber optics, IoT, 5G-advanced, and low-Earth orbit (LEO) satellite services.

Digital Services: Cloud computing, IT security, unified communications as a service (UCaaS), and software-defined wide area networks (SD-WAN).

Business Model Evolution: Transitioning from traditional service providers to full-stack technology partners through digital transformation and co-creation within ecosystems.

“Operators must transform themselves into leaders of the digital transformation revolution,” said Kresimir Alic, IDC’s Research Director for Worldwide Telecom Services. “By becoming modern technology suppliers, telecom providers can secure a central role in the digitalized world.”

This ambitious transformation is vital for telecom companies to maintain relevance and capitalize on emerging opportunities in an increasingly connected global economy.