The fixed broadband market in APAC offers significant investment opportunities, driven by the expansion of fiber-optic infrastructure and the increasing demand for high-speed internet services.

Key factors and trends shaping the market from 2024 to 2029 include:

Total fixed broadband revenue in APAC is projected to grow at a CAGR of 4.6 percent from $334.5 billion in 2024 to $340.5 billion in 2029, as per GlobalData.

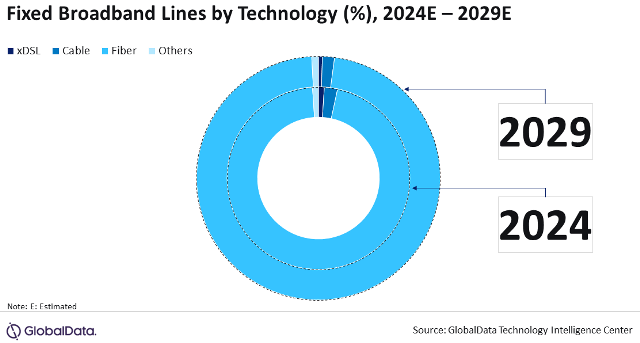

Fiber-optic broadband will dominate the market, accounting for 97 percent of all fixed broadband lines by 2029, underlining the emphasis on high-speed, reliable connectivity.

Governments and private operators across APAC are heavily investing in fiber-optic infrastructure.

Emerging economies like Malaysia, India, and China are focusing on network upgrades through initiatives like Malaysia’s JENDELA and China’s gigabit optical fiber expansion.

Fixed broadband penetration is expected to rise from 22 percent in 2024 to 24 percent by 2029, fueled by infrastructure investments and increased affordability.

For instance, Malaysia’s JENDELA plan aims to connect 9 million premises by 2025, while China targets gigabit fiber connectivity across border towns by the same year.

The rising need for high-speed internet for remote work, streaming, and online education is driving adoption.

Bundled fiber plans offering unlimited internet and value-added services like subscription video-on-demand (SVoD) are attracting customers.

China is expected to remain the largest fixed broadband market in APAC, driven by extensive government-backed fiber upgrades.

MIIT’s gigabit city initiatives have added 97 new cities in 2023, with plans to extend gigabit fiber to all border counties by 2025.

Singapore leads in fiber-to-the-home/building (FTTH/B) penetration, projected to reach 99.7 percent by 2029, supported by government and telco initiatives.

Countries like Australia, New Zealand, and Singapore benefit from early investments in National Broadband Networks (NBN), ensuring high penetration and sustained revenue growth.

Opportunities exist in funding and participating in large-scale fiber deployments in emerging economies like India, Vietnam, and the Philippines.

Collaborations between telcos and streaming platforms to offer bundled services create avenues for higher ARPU and customer retention.

Investments in next-gen technologies such as gigabit and multi-gigabit fiber broadband, complemented by value-added digital services, can unlock long-term growth.

Challenges to Consider

Regulatory Hurdles: Delays in government approvals or funding disbursements may slow deployment timelines.

Competition: Telcos face pricing pressures due to intense competition, potentially impacting margins.

Infrastructure Costs: Fiber rollout requires substantial upfront capital, particularly in underserved regions with challenging terrains.

The APAC fixed broadband market offers robust investment potential, particularly in the fiber broadband segment. Strategic investments in infrastructure, partnerships, and innovative service offerings can position investors to capitalize on the region’s sustained demand for high-speed connectivity. China, Malaysia, and Singapore stand out as key markets to watch, with government-backed initiatives creating a supportive ecosystem for growth.