In a report released today, TrendForce, a leading tech market intelligence firm, reveals that global smartphone production has encountered consecutive quarterly declines in the first half of 2023.

After a staggering 20 percent drop in production during the first quarter (1Q23), the second quarter (Q2) witnessed a further decline of approximately 6.6 percent, bringing total smartphone production to 272 million units. This downturn has resulted in the first half of 2023 totaling a mere 522 million units—a sharp 13.3 percent year-on-year (YoY) decrease, marking a ten-year low for both individual quarters and the first half of the year combined.

After a staggering 20 percent drop in production during the first quarter (1Q23), the second quarter (Q2) witnessed a further decline of approximately 6.6 percent, bringing total smartphone production to 272 million units. This downturn has resulted in the first half of 2023 totaling a mere 522 million units—a sharp 13.3 percent year-on-year (YoY) decrease, marking a ten-year low for both individual quarters and the first half of the year combined.

Key Reasons Behind Slump in Production

TrendForce identifies three primary factors contributing to this production slump:

Eased Pandemic Restrictions in China Fail to Boost Demand: The relaxation of pandemic restrictions in China did not have the anticipated impact on stimulating demand.

Indian Market’s Demographic Dividend Yet to Materialize: The expected boost in demand from the emerging Indian market, known for its demographic dividend, has not translated into substantial consumer demand.

Economic Downturn Affects Consumer Spending: Initially, it was assumed that smartphone brands would return to normal production levels as excess inventory was cleared. However, an ongoing economic downturn has constrained consumer spending, undermining first-half production more than expected.

Transsion Surges, Overtaking Vivo to Enter Global Top 5

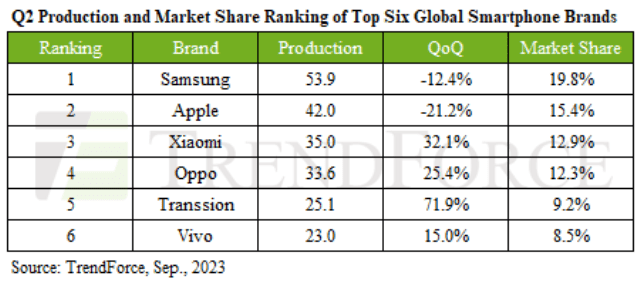

In a significant shake-up of global rankings, Transsion, encompassing brands like TECNO, Infinix, and itel, has surged ahead, claiming the fifth position for the first time. This achievement is attributed to Transsion’s high production output, fueled by inventory replenishment, new product launches, and its entry into mid-to-high-end markets. Transsion’s robust production performance since March indicates that the company’s growth momentum is poised to continue into Q3. In contrast, Vivo (including Vivo and iQoo) has adopted a more cautious approach in a sluggish global economy, leading to a modest 15 percent increase in production in Q2 and a drop to sixth place in global rankings.

Apple Inches Closer to Samsung in Global Market Leadership Race

While Samsung maintains its lead in production rankings, delivering 53.9 million units in Q2, it faced a 12.4 percent quarter-on-quarter (QoQ) decline. Samsung’s Q2 performance lagged behind the same period last year due to global economic challenges and fierce competition. Apple, traditionally weaker in the second quarter due to product transitions, produced 42 million units in Q2—a 21.2 percent decline from the preceding quarter. The upcoming iPhone 15/15 Plus release may face challenges due to suboptimal yields in its CMOS Image Sensors, potentially impacting Q3 production. Apple and Samsung are now closely competing for global market leadership in 2023.

Xiaomi and Oppo Experience Robust Growth in Q2

Xiaomi, including brands like Xiaomi, Redmi, and POCO, posted impressive Q2 production numbers of approximately 35 million units—a remarkable seasonal uptick of 32.1 percent. This surge can be attributed to strategic channel inventory management and the appeal of new product launches. Oppo, including Oppo, Real, and OnePlus, also experienced a prosperous Q2, capitalizing on rebounding demand in Southeast Asia and other regions, producing approximately 33.6 million units, marking a seasonal increase of 25.4 percent. Both companies are poised for growth in Q3, targeting markets in China, South Asia, Southeast Asia, and Latin America.

Uncertain Economic Recovery May Further Reduce Smartphone Production in H2

Despite hopes for economic recovery, consumer demand in key markets like China, Europe, and North America has not seen significant rebounds as we enter the second half of the year. The outlook for the Indian market remains uncertain, making it challenging to reverse the global decline in smartphone production. TrendForce predicts that the smartphone market may experience further shifts in Q2 2023 due to poor global economic conditions, potentially leading to reduced production in the second half. Looking ahead to 2024, the current economic outlook remains pessimistic, with TrendForce maintaining its forecast of a 2~3 percent annual increase in global production, depending on regional economic trends, but acknowledging the possibility of further production declines.