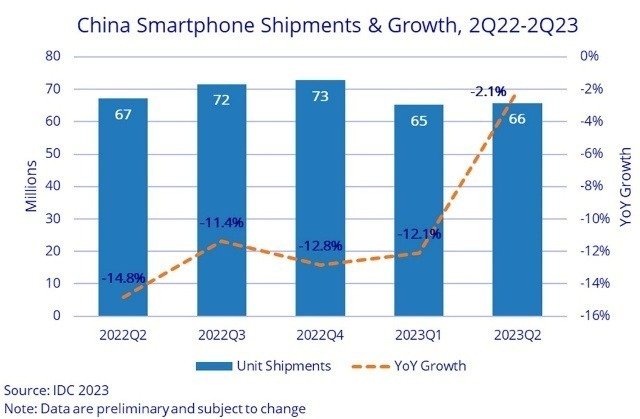

In the second quarter of 2023, the Chinese smartphone market showed signs of a modest recovery, with 65.7 million smartphones shipping across the country. This figure represents a narrower decline of 2.1 percent compared to the same period last year, as reported by the IDC Worldwide Quarterly Mobile Phone Tracker.

Despite the positive growth in 2Q23, the first half of the year saw a total of 130.9 million shipments, indicating a 7.3 percent year-on-year decrease. The sluggish consumer demand recovery during the first half of the year offset the efforts of smartphone vendors and e-commerce operators to offer bigger discounts during the popular 618 online shopping festival. As a result, sales experienced a more-than-5 percent drop during the event, signaling ongoing challenges in the short term.

Despite the positive growth in 2Q23, the first half of the year saw a total of 130.9 million shipments, indicating a 7.3 percent year-on-year decrease. The sluggish consumer demand recovery during the first half of the year offset the efforts of smartphone vendors and e-commerce operators to offer bigger discounts during the popular 618 online shopping festival. As a result, sales experienced a more-than-5 percent drop during the event, signaling ongoing challenges in the short term.

Oppo (17.7 percent share), Vivo (17.2 percent), Honor (16.4 percent), Apple (15.3 percent), Xiaomi (13.1 percent and Huawei (13 percent) are the top smartphone makers in China during the second quarter of 2023.

In the midst of these challenges, Huawei made a notable comeback, securing a spot in the Top 5 smartphone vendors in China, tying with Xiaomi. The return of Huawei to the top rankings was attributed to its improved product launching pace and the favorable sales performance of its P60 series and foldable Mate X3 model.

Among the top-tier vendors, both Huawei and Apple were the only companies to achieve positive year-on-year growth. Apple’s success was credited to the price discounts offered on its iPhone 14 series, which effectively stimulated demand in the market.

Will Wong, Senior Research Manager for Client Devices at IDC Asia/Pacific, highlighted the emerging challenges faced by the leading vendors. With Huawei’s resurgence potentially triggering more competition in the high-end segment, intensified rivalry is expected to be seen, especially during the product launch period and the upcoming Singles’ Day shopping festival.

While the market experienced a mild recovery during 2Q23, the industry remains cautiously optimistic about the future. Factors like evolving consumer preferences and increasing competition will play a crucial role in shaping the dynamics of China’s smartphone market in the coming months.