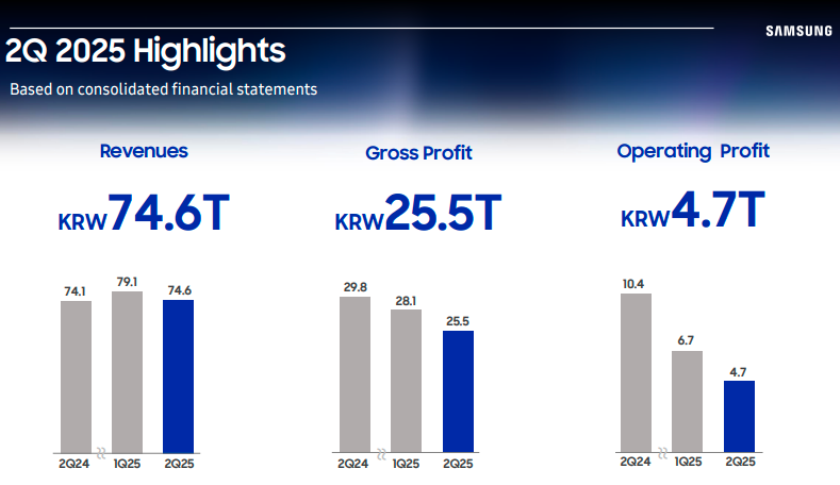

Samsung Electronics has reported revenue of KRW 74.6 trillion in Q2-2025, reflecting 1 percent rise from Q2-2024 and a 5.8 percent decline from the previous quarter. Operating profit stood at KRW 4.7 trillion.

The DX (Device eXperience) division posted KRW 43.6 trillion in revenue, up from KRW 42.1 trillion a year earlier, marking a 4 percent rise. Within DX, the MX/NW (Mobile eXperience/Network) segment grew 7 percent to KRW 29.2 trillion, driven by a 7 percent increase in MX revenue to KRW 28.5 trillion.

The VD/DA (Visual Display/Digital Appliances) business declined slightly by 2 percent to KRW 14.1 trillion, with VD sales dropping 7 percent to KRW 7.0 trillion.

The DS (Device Solutions) division, which includes semiconductors, reported a 3 percent drop to KRW 27.9 trillion from KRW 28.6 trillion, although memory sales rose 3 percent to KRW 21.2 trillion.

SDC (Samsung Display Corporation) recorded KRW 6.4 trillion, showing a strong 17 percent increase from KRW 5.5 trillion a year ago.

Harman posted KRW 3.8 trillion in revenue, growing 6 percent from KRW 3.6 trillion in Q2 2024.

The Device Solutions (DS) Division recorded an increase in revenue, driven by stronger sales of high-density and high-performance memory products. However, profit was affected by inventory value adjustments and costs tied to export restrictions impacting non-memory products. Samsung anticipates continued AI-driven demand in the second half of 2025 and plans to meet this with an expanded product portfolio, including HBM, LPDDR5x, DDR5, GDDR7, and high-density SSDs. The company aims to accelerate the transition to 8th generation V-NAND and improve profitability in the Foundry Business through the ramp-up of 2nm GAA-based chips and better fab utilization.

System LSI reported solid revenue from advanced SoCs, but profitability was limited due to high development costs. In H2, it will focus on boosting Exynos competitiveness and expanding high-end sensor sales. The Foundry Business expects improved utilization rates and customer expansion, despite earlier weakness caused by export restrictions and low activity in legacy nodes.

Samsung Display Corporation saw increased revenue in Q2, helped by strong demand for mobile displays and QD-OLED monitors. Looking ahead, the company will leverage upcoming smartphone launches, grow its presence in IT and automotive segments, and expand its QD-OLED lineup to sustain growth amid uncertain market conditions.

The Mobile eXperience (MX) Business achieved year-on-year growth in revenue and profit, supported by strong sales of the Galaxy S25, Galaxy A series, and tablets. Despite lower shipments compared to Q1, profitability remained strong. In the second half, MX will pursue a flagship-focused strategy with an emphasis on foldables and AI-enhanced features across devices. It will also expand into new form factors like XR and TriFold, while managing rising component costs. The Networks Business improved margins through overseas expansion and will continue focusing on new orders and cost optimization.

Samsung’s Network Business division said it increased profitability by expanded overseas revenue and improved resource efficiency. Samsung’s Network Business division aims to achieve revenue targets and recover competitiveness by securing new orders with optimized cost.

The Visual Display and Digital Appliances units improved their premium product sales in Q2 but faced profit pressure due to weak demand and competition. Samsung plans to target peak-season demand in H2 with a stronger lineup of AI-powered high-value TVs and differentiated services like SmartThings, Samsung Knox, and TV Plus, aiming to enhance customer experience and ensure steady revenue growth. Across all segments, Samsung’s strategy emphasizes high-value offerings, AI innovation, and operational efficiency to strengthen its competitive edge in the face of global uncertainties.

Baburajan Kizhakedath