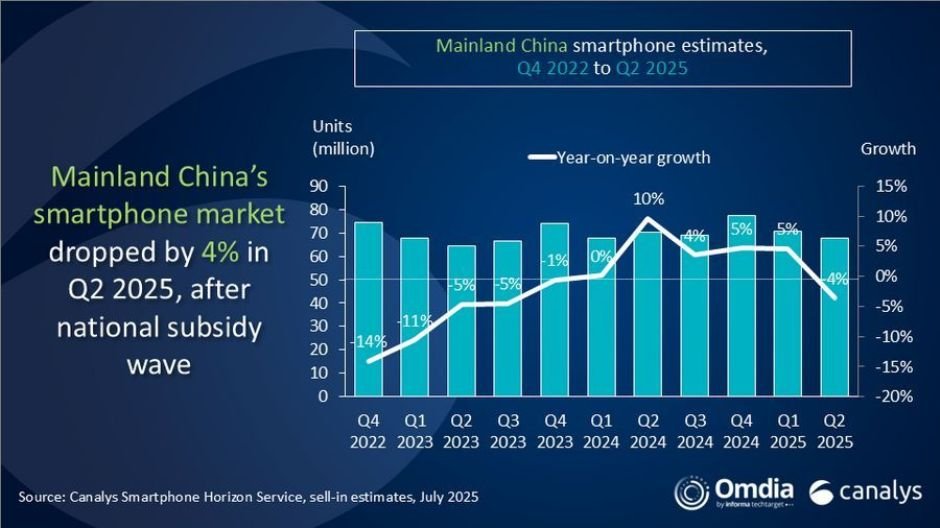

China’s smartphone market declined 4 percent year-on-year in Q2 2025, following an earlier demand surge from national subsidy programs.

Despite the slowdown, first-half shipments saw a slight year-on-year increase, reflecting resilient underlying consumer demand, Amber Liu, Practice Leader at Canalys (now part of Omdia), said.

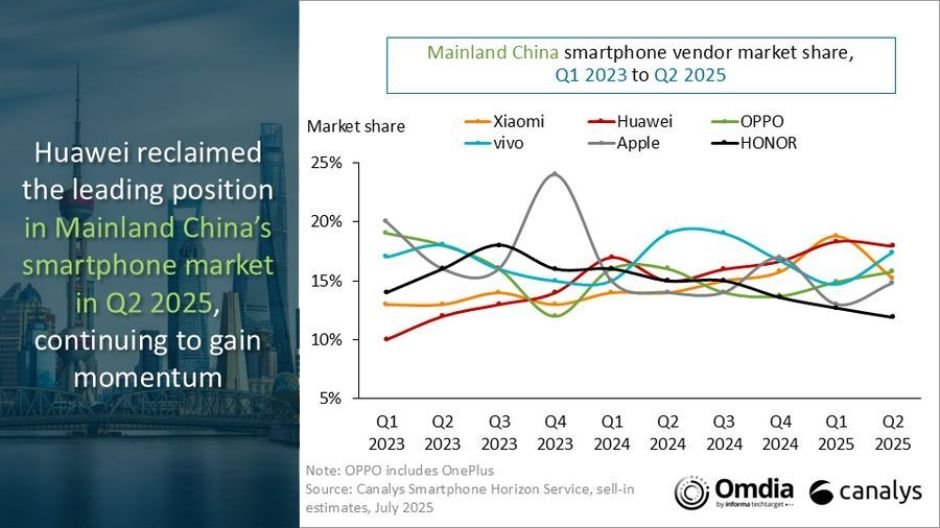

Huawei reclaimed the top spot with 12.2 million units and 18 percent market share, followed by vivo (17 percent), OPPO including OnePlus (16 percent), Xiaomi (15 percent)—marking its eighth consecutive quarter of growth—and Apple (15 percent).

Chinese smartphone market

In Q2 2025, Huawei led the Chinese smartphone market with shipments of 12.2 million units, increasing from 10.6 million in Q2 2024, and boosting its market share from 15 percent to 18 percent.

Vivo shipped 11.8 million units, down from 13.1 million, resulting in a drop in share from 19 percent to 17 percent. OPPO (including OnePlus) experienced a shipment decline from 11.3 million to 10.7 million, maintaining a steady 16 percent share.

Xiaomi grew its shipments from 10.0 million to 10.4 million, raising its share from 14 percent to 15 percent.

Apple increased shipments from 9.7 million to 10.1 million, also reaching 15 percent share, up from 14 percent a year earlier.

The Others category saw the sharpest decline, with shipments dropping from 15.8 million to 12.7 million, and market share falling from 22 percent to 19 percent.

Vendors adapted to shifting market dynamics with differentiated strategies. Huawei launched the Nova 14 series with HarmonyOS 5.0, boosting its ecosystem. vivo introduced multiple models with a staggered launch approach.

Xiaomi unveiled its in-house chipset, XRing O1, for its flagship Xiaomi 15s Pro and expanded its retail presence to support its “Human x Car x Home” strategy. Apple adjusted iPhone 16 pricing to drive sales during the “618” festival, but was impacted by subsidy limitations. HONOR focused on competitive mid-range offerings and disciplined channel management.

Looking ahead, Canalys (now part of Omdia) expects modest full-year growth in China’s smartphone market, likely outpacing global performance. Inventory remains stable, and vendors are now tasked with maintaining momentum through innovation, ecosystem development, and strengthened channel partnerships.

TelecomLead.com News Desk