The global AR/VR headset market is undergoing a pivotal transformation, marked by a strong rebound in the latest quarter with 18.1 percent year-over-year growth.

Customer spending is increasingly shifting toward immersive and multifunctional experiences, with demand driven by form factor innovations, AI integration, and the evolving utility of mixed and extended reality platforms.

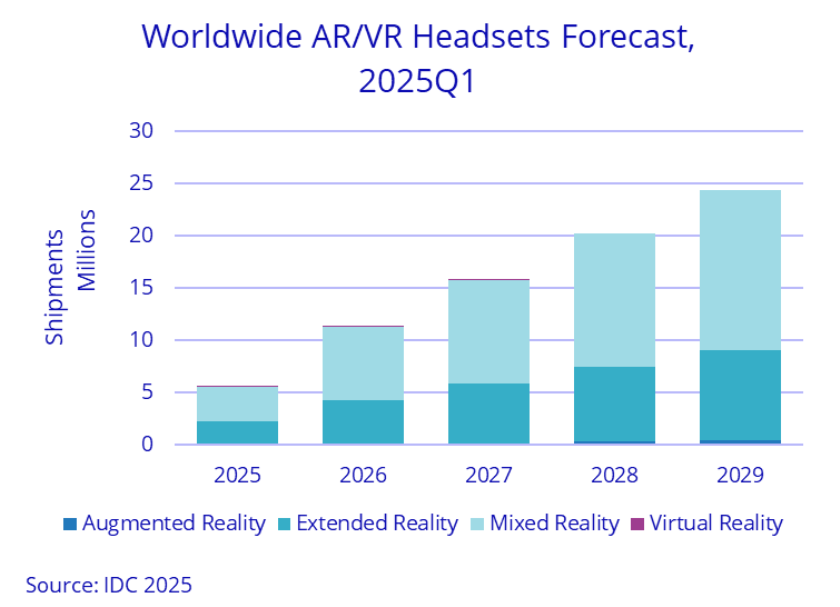

While overall shipment volumes are projected to dip by 12 percent in 2025 due to delayed product launches, IDC forecasts a sharp recovery in 2026 with 87 percent growth, and a long-term CAGR of 38.6 percent through 2029.

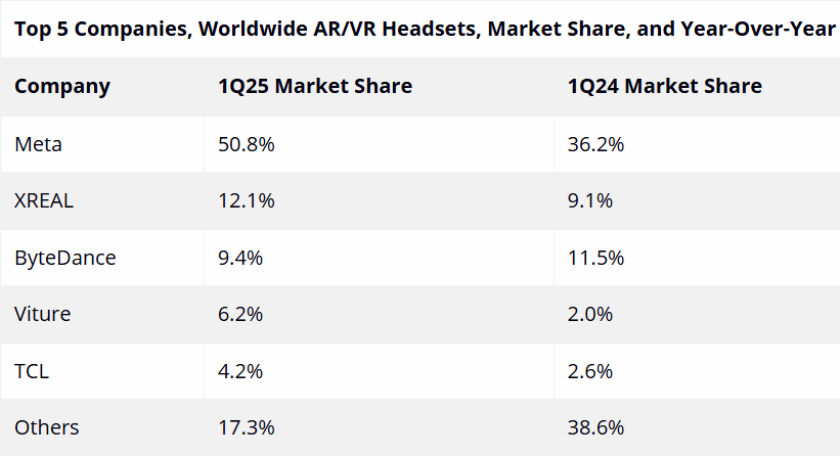

Vendor strategies are diverging notably. Meta retained leadership with a 50.8 percent market share, leveraging a strong VR portfolio. Emerging players like XREAL, which ranked second, and Viture, which posted a staggering 268.4 percent annual growth, are capitalizing on optical-see-through (OST) glasses.

TCL also made gains with a 91.6 percent increase in shipments. These vendors are focusing on lightweight designs and cross-platform compatibility to attract both gamers and professionals. In contrast, legacy players like Sony and Apple were absent from the top five due to sufficient channel inventory and a pause in new product rollouts.

Innovation is centering around the convergence of AI, MR, and Android-based XR platforms. IDC notes a significant shift from pure VR and AR to MR and ER, with shipments of MR headsets projected to rise from 3.3 million in 2025 to 15.2 million in 2029, while ER is expected to grow from 2.2 million to 8.6 million units. These changes are being fueled by new use cases across consumer and enterprise applications, including gaming, remote collaboration, and hands-free productivity.

Market share dynamics underscore a broader realignment. Meta remains dominant, but OST-specialized vendors — XREAL, Viture, and TCL — now account for a combined 22.5 percent share, reflecting a clear tilt toward emerging device formats.

Meta led the AR/VR headset market with a 50.8 percent share in Q1 2025, up from 36.2 percent in Q1 2024. XREAL followed with 12.1 percent, rising from 9.1 percent. ByteDance held 9.4 percent, down from 11.5 percent. Viture increased its share to 6.2 percent from 2.0 percent, while TCL grew to 4.2 percent from 2.6 percent. Other vendors collectively dropped to 17.3 percent from 38.6 percent.

With Google’s Android XR platform gaining traction and major players pivoting strategies, the AR/VR market is on the verge of its most significant evolution to date.

TelecomLead.com News Desk