Apple’s iPhone 14 Pro Max has emerged as the most shipped smartphone globally in the first half of this year, according to the latest data from Omdia’s Smartphone Model Market Tracker – 2Q23.

The impressive performance of Apple’s premium models amidst a challenging smartphone market highlights the brand’s stronghold on consumer preferences.

The impressive performance of Apple’s premium models amidst a challenging smartphone market highlights the brand’s stronghold on consumer preferences.

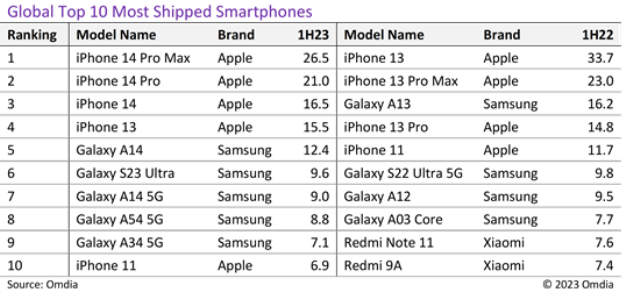

In the first six months of 2023, Apple achieved a remarkable milestone, shipping a total of 26.5 million units of the iPhone 14 Pro Max. This flagship device from Apple’s 14 series, launched in September of the previous year, stands out as the most expensive model in the lineup, with prices ranging from $1,099 to $1,599, the report said.

Securing the second spot in the rankings is the Apple iPhone 14 Pro, priced between $999 and $1,499, followed by the iPhone 14 in third place. The success of the iPhone 14 series is further exemplified by its third model, the iPhone 14, entering the top 10 smartphone models chart for the quarter.

When compared to the top 10 models of the same period last year, the shipment volume for this year’s leader, the iPhone 14 Pro Max, witnessed a decline of 7.2 million units. The iPhone 13 held the top spot last year with a total of 33.7 million units shipped. However, the successor to the iPhone 13 Pro Max, the iPhone 14 Pro Max, managed to ship 3.5 million units more this year and moved up one position in the rankings. The iPhone 14 Pro also exhibited growth, with shipments increasing by 6.2 million units compared to its predecessor, the iPhone 13 Pro, leading to a two-spot rise in the rankings. Nevertheless, shipments of the standard iPhone 14 model declined by 17.2 million units compared to the iPhone 13.

In the global smartphone market, negative growth is evident due to economic recession affecting the mid- to low-end market and the expansion of the used smartphone segment. However, the premium smartphone market is showing resilience, with Apple’s premium models experiencing solid replacement demand. Furthermore, Apple’s brand preference, particularly in emerging markets, is leading to increased sales of high-end models like the Pro and Max within the iPhone series.

Among the top 10 models, five are from Apple, while the remaining five are Samsung smartphones. Samsung’s Galaxy A14, ranking fifth, recorded the highest shipment volume among Samsung models, with 12.4 million units. Samsung’s premium model, the Galaxy S23 Ultra, maintained its ranking but experienced a slight dip in shipments to 9.6 million units. The Galaxy A14 5G, A54 5G, and A34 5G ranked 7th, 8th, and 9th respectively.

Notably, Xiaomi’s Redmi series, which secured two spots in the top 10 last year, failed to make the list this year due to the continuous decline in shipments of Chinese smartphone makers, attributed to the downturn in the mid- to low-end smartphone market.

Looking ahead, Omdia predicts a further decline in global smartphone shipments this year. The slump in the mid- to low-end market is expected to persist into the second half of the year, while the premium market is anticipated to continue growing with the introduction of the new iPhone 15 series. This trend will likely result in negative growth for Android-based smartphone OEMs with a significant share of mid- to low-priced devices. Meanwhile, Apple’s shipments of Pro and Pro Max models are expected to rise due to sustained demand, although overall iPhone shipments may remain steady or experience a slight decrease due to weaker demand for standard and plus models, according to Jusy Hong, Senior Research Manager at Omdia.