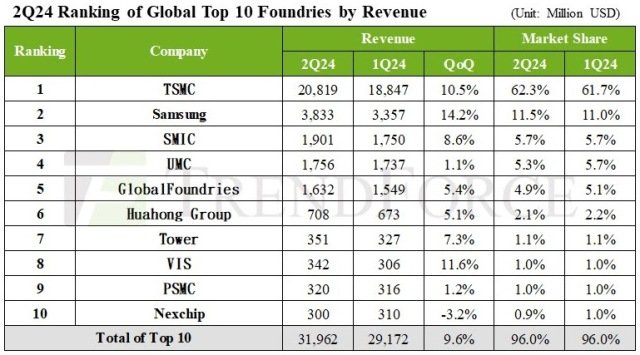

Research firm TrendForce has revealed the market share of top 10 wafer foundries during the second-quarter of 2024.

Strong demand for AI servers boosted the revenue of the world’s top ten wafer foundries by 9.6 percent in 2Q24 — reaching $32 billion.

TSMC, Samsung, SMIC, UMC, and GlobalFoundries are the top five wafer foundry companies, according to TrendForce.

Among the sixth to tenth spots, VIS benefited from urgent DDI orders and the de-risking bonus from PMIC, which drove shipment growth, elevating its rank to eighth.

PSMC and Nexchip fell to ninth and tenth, respectively, as such making the rankings: HuaHong Group, Tower, VIS, PSMC, and Nexchip.

TSMC’s wafer shipments rose by 3.1 percent, driven by Apple’s restocking cycle and strong demand for AI server-related HPC chips. The increased contribution from high-priced advanced processes led to a 10.5 percent increase in revenue to $20.82 billion, securing a market share of 62.3 percent.

Samsung Foundry, benefiting from Apple’s restocking for the new iPhone and the ramp-up of related ICs such as Qualcomm’s 5/4nm 5G modem and 28/22nm OLED DDI, saw its revenue grow by 14.2 percent to $3.83 billion, holding steady at an 11.5 percent market share and ranking second.

SMIC experienced a significant boost in urgent orders during China’s 618 shopping festival, leading to a remarkable 17.7 percent rise in wafer shipments and 8.6 percent increase in revenue, reaching $1.9 billion. This allowed SMIC to maintain a solid 5.7 percent market share, securing its position in third place.

UMC reported 2.6 percent growth in wafer shipments, and a 1.1 percent increase in revenue to $1.76 billion. This growth was fueled by urgent mid-year demands — especially for TV-related ICs and low-end MCUs in consumer electronics — leading to UMC holding a 5.3 percent market share and ranking fourth.

GlobalFoundries saw an uptick in wafer shipments during Q2, although some of the gains were offset by a decline in ASP. GlobalFoundries revenue rose 5.4 percent to $1.63 billion, while maintaining a 4.9 percent market share in fifth place.

HuaHong benefited from heightened capacity utilization and improved shipment performance, thanks to the mid-year promotional season, resulting in a 5.1 percent revenue increase to $708 million and a 2.1 percent market share, placing it sixth.

Tower enjoyed greater wafer shipments a more favorable product mix, leading to a 7.3 percent rise in revenue to $351 million, securing a 1.1 percent market share in seventh place.

VIS experienced a notable boost in capacity utilization during the second quarter, driven by urgent orders linked to the 618 shopping season and heightened demand from non-Chinese PMIC clients. The company reported a 19 percent increase in wafer shipments, leading to an 11.6 percent revenue jump to $342 million. The performance allowed VIS to capture a 1 percent market share and surpass PSMC and Nexchip to snatch eighth place.

PSMC saw a gradual recovery in its memory foundry sector, but its logic foundry business remained stagnant, resulting in a modest 1.2 percent revenue bump to $320 million and holding a 1 percent market share at ninth place.

Nexchip reported Q2 revenue of $300 million, reflecting a decline of about 3.2 percent from the previous quarter. The company held a 0.9 percent market share, placing it at tenth place.

Intel Foundry Service (IFS), which briefly held the ninth position in 3Q23, revamped its revenue model starting in 1Q24, achieving revenues of $4.4 billion and $4.3 billion in the first two quarters, respectively. Intel Foundry faced significant operating profit margins of -57 percent and -66 percent during these periods. Considering 98-99 percent of IFS’s revenue is generated from internal customers, with a mere 1 percent coming from external sales of equipment, materials, and testing services, which ultimately prevented IFS from breaking into the top 10 foundries this quarter when only external revenue was taken into account.

TrendForce points out that Q3 marks the start of the traditional peak season for inventory buildup. New smartphone and PC/NB product launches in the second half of the year are expected to generate solid demand for SoCs and peripheral ICs.

Coupled with ongoing rapid growth in HPC demand related to AI servers, demand is expected to remain strong through the end of the year, with some advanced process orders already extending visibility into 2025.