Telkom Indonesia has revealed its strategy and growth plans to enhance customer experience in fiber broadband business.

Telkom’s Capex (capital expenditure) accounts for 22 percent of total revenue in 2023. Telkom says its focus is on developing the mobile, fixed broadband, data center & cloud, and infrastructure businesses in Indonesia.

Telkom annual report says has 176,663 km fiber optic backbone network. This includes 111,663 km domestic fiber optic and 64,700 km international fiber optic.

Telkom’s fiber optic access network passes 38 million homes. Telkom has 16 million optical port at the end of 2023.

Competition

Telkom brand IndiHome is the market leader in fixed broadband business in Indonesia with 10.1 million subscribers and 66.7 percent of market share.

Competitors in the fixed broadband industry are First Media, MyRepublic, Biznet Home, MNC Play, CBN Fiber, XL Home, Oxygen.id, Indosat HiFi and Iconnet.

Telkom has 159.3 million cellular subscribers; 7.5 million Halo subscribers; 151.8 million prepaid subscribers; 137.2 million broadband subscribers; fixed broadband IndiHome 10.1 million subscribers; and 127.1 million mobile broadband subscribers.

IndiHome subscribers in 2023 increased by 9.5 percent to 10.1 million. The average revenue per user (ARPU) for IndiHome B2C was Rp252.7 thousand against Rp270 thousand. Its strategy of focusing more on the youth and customer of tomorrow resulted into decrease in ARPU.

Telkom is improving the IndiHome B2C to maintain and attract its subscribers. The strategies are the bundling program consisting of internet broadband, IP-TV, and fixed wireline telephone, sales via digital channels, and promotions every year. IndiHome B2C is also committed to delivering high-quality services and digital entertainment to subscribers.

subscriber base

Telkom has 10.1 million subscribers of IndiHome fixed broadband. It has 66.7 percent fixed broadband market share in Indonesia. Telkom offers more services for subscribers of wifi.id that offers unlimited internet access to the entire wifi.id access spots across Indonesia.

Telkom had 16 million optical ports at the end of 2023 with fiber optic as the basis for fixed broadband network access. Telkom also enhances its Mean Time To Install (MTTI) and Mean Time To Repair by improving technicians’ capacity and business processes.

Telkom has 175,692 km of fiber optic network covering 501 cities/regencies.

Telkom says data traffic 2023 increased by 9 percent to 17.9 million TB in 2023. Telkom’s cellular subscribers at the end of 2023 were 159.3 million subscribers, with 95.3 percent prepaid subscribers and 4.7 percent postpaid subscribers. It increased by 1.6 percent from the 2022.

The mobile broadband subscribers increased by 5.1 percent to 127.1 million subscribers, and data usage increased by 9 percent to 17.9 million TB in 2023.

In 2023, Telkomsel has completed the network switching process from 3G to 4G, which began in March 2022. It was a gradual process of switching networks on more than 49 thousand 3G BTS and building more than 32 thousand new 4G BTS.

Telkomsel also built 370 new 5G BTS. At the end of 2023, Telkom had 197.8 thousand 4G BTS and 654 5G BTS to accommodate the subscribers’ digital activities. Telkomsel does not reveal the number of 5G subscribers.

Growth in Indonesia

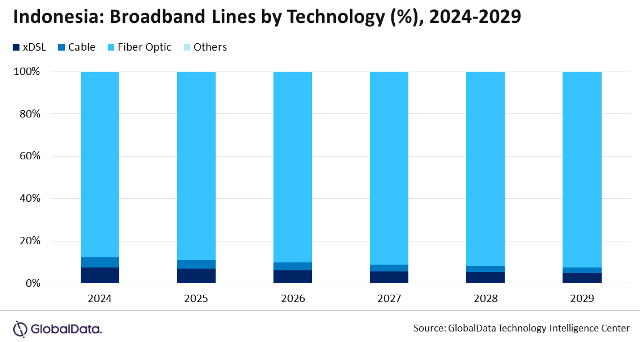

Research firm GlobalData says the fixed communication services revenue in Indonesia is forecast to increase at a CAGR of 4.6 percent from $3.2 billion in 2024 to $4 billion in 2029 as fiber broadband service adoption gains traction.

Fixed broadband service revenue will increase at a CAGR of 4.9 percent during 2024-2029 as fixed broadband household penetration gains pace, especially with growing adoption of higher ARPU fiber-optic (FTTH/B) services.

Telkom Indonesia will lead both fixed voice and broadband service segments, by subscriptions over the forecast period. Srikanth Vaidya, Telecom Analyst at GlobalData, says Telkom will invest Rp280 billion ($18 million) for the development of the National Capital City (IKN) of Nusantara until 2026. A substantial portion of this investment would be used for installing fiber optics in the Core Government Center (KIPP) 1A area.