GSMA has released an update on AI deployments by the telecom industry during Q2-2025 indicating most deployments are being driven by cost savings, with the remaining 15–20 percent targeted at revenues through new or upgraded products.

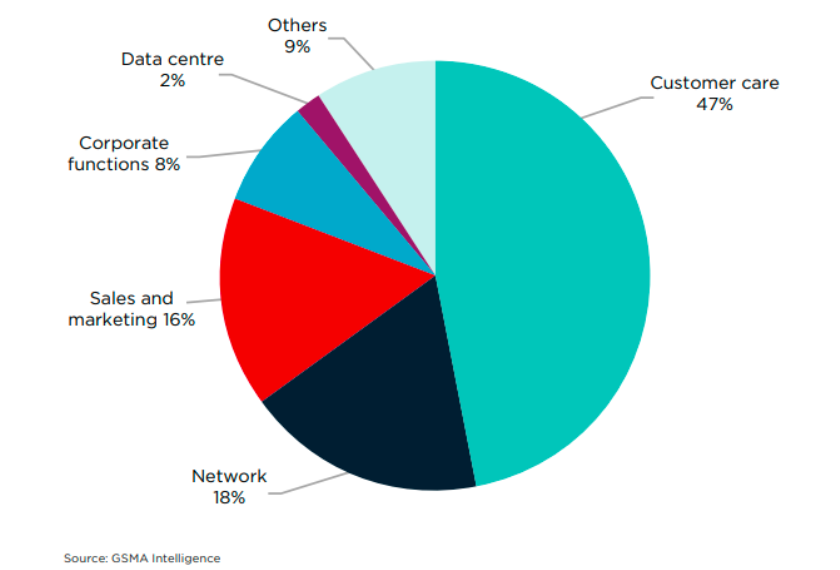

Customer care dominates telco AI deployments, representing about 47–50 percent of tracked projects, driven largely by cost-saving automation and churn reduction. Network-related AI accounts for around 20 percent, primarily for pre-emptive fault detection.

Around 75–80 percent of deployments aim to cut costs, while only 10–20 percent focus on generating new revenue, with early revenue-driving use cases such as GPU-as-a-Service and agentic AI expected to grow in 2025–2026.

About 60 percent of deployments are already live, while 40 percent remain in trial or planning stages, reflecting an ongoing cycle of experimentation rather than a linear rollout. In AI investment priorities, operators emphasise upskilling (63 percent) and network capacity (62 percent) to handle increasing and more complex traffic.

Recent telco AI developments include Telkomsel partnering with Perplexity to expand AI adoption, Ooredoo launching its GPT-4o-powered chatbot “Obot,” A1 working with Cognigy to enhance corporate customer service, Safaricom teaming with iXAfrica Data Centres to build Kenya’s first AI-ready enterprise infrastructure, and e& UAE deploying AI-powered drones for telecom tower operations.

In technology collaborations, TCS and Nvidia are designing AI-native telecom solutions, Telenor is expanding sovereign AI infrastructure, Ericsson and Bell Canada have tested AI-native link adaptation, Indosat Ooredoo Hutchison opened an AI experience center in Jayapura, and Ericsson with Google Cloud is delivering a carrier-grade AI-driven 5G core.

On the regulatory side, the EU has launched an ‘Apply AI’ strategy consultation, the UAE is using AI to draft laws, Italy’s Senate is collaborating with Fastweb on generative AI, Saudi Arabia and Nvidia are building AI factories, and the European Broadcasting Union is partnering with Nvidia on sovereign AI for public broadcasters.

Asia Pacific leads in AI deployment intensity, averaging about four projects per operator, with higher numbers in China, Japan, and South Korea, followed by Europe at nearly three. Activity in Asia Pacific and Europe has plateaued between March and June, indicating a focus on implementation and monitoring, while MENA and Sub-Saharan Africa are still ramping up. Most early deployments, 80–85 percent, target cost savings through efficiencies in customer care, network fault detection, and OSS/BSS, while revenue-generating AI use cases such as GPUaaS and agentic AI remain in the early stages but are expected to expand in 2025–2026.

Customer care is the most advanced area, with about 75 percent of deployments live, followed by operator data centres and sales & marketing at around 60 percent, while other areas are at about 50 percent. The shift from trials to live deployments will hinge on measurable returns, whether through cost reduction or revenue growth.

Operators in the Americas and Europe are among the first to market with AI, showing higher maturity despite fewer total deployments, while Asia Pacific has a larger volume of projects but many remain in trials. 2025 is set to mark a shift from testing and validation to commercialisation, with the coming years characterised by repeating cycles of trial, deployment, and innovation. About half of the 250 operators analysed have disclosed their AI partners, which include chipset makers, network vendors, LLM specialists, enterprise IT firms, and hyperscalers.

Nvidia stands out as a leading GPU provider, though competition from Google’s Gemini, OpenAI, and other hyperscalers remains strong. Perplexity has rapidly built a presence as an AI-driven search engine, signalling a potential move by telcos to diversify away from Google’s dominance and integrate alternative search capabilities into customer interfaces.

Baburajan Kizhakedath