SK Hynix and Samsung are navigating the AI-driven semiconductor boom with contrasting momentum.

While Samsung faces challenges from export restrictions and delayed qualifications for advanced memory, SK Hynix is harnessing the surge in artificial intelligence demand to drive record-breaking revenue, expand its product roadmap, and strengthen its global leadership in high-performance memory, notably surpassing Samsung in key AI-focused segments.

In the second quarter, SK Hynix posted its highest-ever operating profit of ₩9.2 trillion — up 69 percent — and revenue of ₩22.2 trillion, a 35 percent increase, fueled by booming demand for high-bandwidth memory (HBM) chips used in AI systems.

This surge has propelled SK Hynix to the forefront of the global memory market, overtaking Samsung Electronics in DRAM market share (36 percent vs. 34 percent) during the first quarter, largely on the strength of its HBM portfolio, Financial Times reports.

SK Hynix now leads in HBM shipments, with growing demand for its 12-high HBM3E and increased volumes of DRAM and NAND flash tailored for AI applications. Strategic momentum and investor confidence have pushed SK Hynix’s market capitalization to over half that of Samsung, backed by strong foreign investment and positive market sentiment, Reuters news report said.

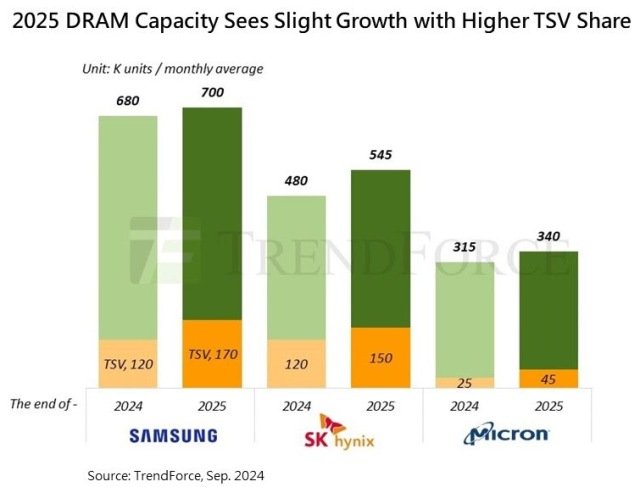

In response to rising AI memory demand and sovereign AI initiatives, SK Hynix plans to ramp up investment in 2025, aiming to double HBM chip sales compared to 2024 and lock in long-term supply agreements with customers including Nvidia, despite ongoing geopolitical risks such as potential U.S. semiconductor tariffs.

Song Hyun Jong, President and Head of Corporate Center, said that SK Hynix will carry out part of the planned investments preemptively this year for smooth provision of major products with visible demand for next year including HBM.

SK Hynix is also preparing for next-generation product rollouts, including HBM4 and GDDR7, and is diversifying into LPDDR-based server modules and QLC-based high-capacity eSSDs. This product strategy is designed to reinforce its position as a full-stack AI memory provider. The company’s healthy cash position and reduced debt ratio enable it to accelerate capital spending while navigating external risks.

In contrast, Samsung Electronics reported a 56 percent drop in Q2 operating profit to around ₩4.6 trillion, citing export restrictions on AI chips to China and delays in qualifying its HBM3E for Nvidia.

While Samsung remains a dominant player in general memory and semiconductor markets, it currently trails SK Hynix in the high-end AI memory space. Samsung is now shifting its focus to China-based operations, awaiting key certifications, and implementing share buybacks to restore investor confidence.

Strategically, SK Hynix is capitalizing on the AI boom by investing in HBM infrastructure, deepening customer relationships, and delivering strong financial results.

Samsung, meanwhile, is attempting to regain ground through diversification and tactical responses to external headwinds.

SK Hynix is leading the AI-driven memory race with aggressive investments, market share gains, and a forward-looking roadmap, while Samsung works to overcome competitive and regulatory challenges to reassert its leadership in advanced memory solutions.

Baburajan Kizhakedath