T-Mobile has reported total revenues of $21.1 billion in Q2 2025, up from $19.8 billion in Q2 2024, driven primarily by strong growth in service and equipment revenues.

T-Mobile’s service revenues rose 6 percent to $17.4 billion, largely fueled by a 9 percent increase in postpaid service revenues due to higher average revenue per account and a growing account base. Equipment revenues of T-Mobile increased 11 percent to $3.4 billion, supported by a higher average revenue per device sold and greater sales of high-end smartphones.

T-Mobile’s net income for the second quarter reached $3.2 billion, an increase from $2.9 billion a year earlier. Adjusted EBITDA grew 6 percent to $8.5 billion, maintaining a healthy 49.0 percent margin of service revenues.

The company raised its 2025 guidance for postpaid net customer additions, Core Adjusted EBITDA, and free cash flow, citing continued customer growth and operational momentum.

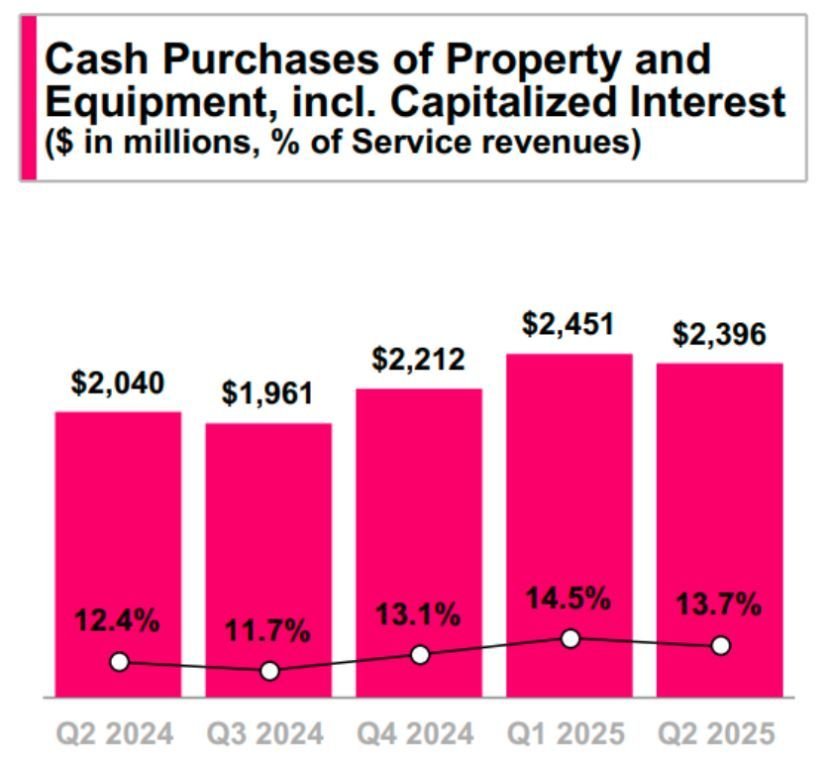

T-Mobile’s Capex were $2,451 million in Q1-2025 and $2,396 million in Q2-2025. T-Mobile is aiming for annual Capex of $9.5 billion in 2025.

Subscribers

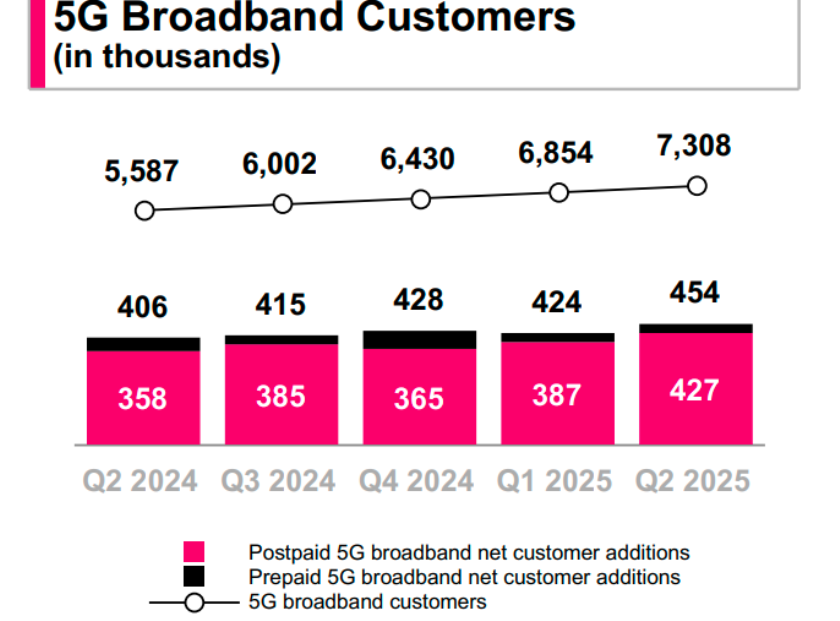

T-Mobile has added 1.77 million customers in Q2-2025, bringing its total customer base to 132.8 million. This included 1.73 million postpaid customers, of which 830,000 were postpaid phone customers and 902,000 were from other postpaid categories like mobile internet and 5G broadband. The growth in postpaid subscribers was driven by higher gross additions and increased migrations from prepaid to postpaid plans, despite elevated churn from temporary rate plan optimizations.

T-Mobile also acquired 97,000 postpaid fiber customers and 85,000 postpaid accounts through the Lumos acquisition. Prepaid net customer additions were 39,000, reflecting higher deactivations from a growing base, increased churn, and more customers moving to postpaid plans.

Additionally, T-Mobile added 454,000 net 5G broadband customers, reaching a total of 7.3 million such customers by the end of the quarter.

ARPU

T-Mobile’s postpaid phone ARPU increased 3 percent to $50.62 in Q2 2025, primarily driven by rate plan optimizations, higher fee revenue from tax and fee exclusive plans, and greater adoption of premium services. Growth was partially offset by promotional activity and the expansion of bundled offerings.

T-Mobile’s postpaid ARPA rose 5 percent year-over-year to $149.87 due to more customers per account, continued 5G broadband adoption, and increased business customer penetration. Sequentially, both ARPU and ARPA saw gains supported by similar factors, though moderated by promotional intensity and growth in lower-ARPU customer segments like broadband and fiber-only users.

T-Mobile’s prepaid ARPU declined to $34.63, down from $35.94 a year earlier, mainly due to mix changes following the Ka’ena acquisition and higher churn.

TelecomLead.com News Desk