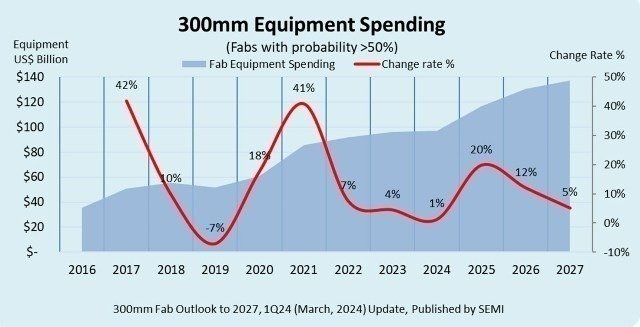

SEMI forecasts a surge in 300mm fab equipment spending, with a projected record of $137 billion by 2027, driven by the resurgence of the memory market and robust demand for high-performance computing and automotive applications. This forecast comes after the expenditure is anticipated to surpass $100 billion for the first time by 2025, marking a significant milestone in the industry’s trajectory.

According to the SEMI 300mm Fab Outlook Report to 2027, 300mm fab equipment investment is poised to witness a 20 percent increase to US$116.5 billion in 2025, followed by a 12 percent rise to $130.5 billion in 2026 before reaching an all-time high in 2027.

According to the SEMI 300mm Fab Outlook Report to 2027, 300mm fab equipment investment is poised to witness a 20 percent increase to US$116.5 billion in 2025, followed by a 12 percent rise to $130.5 billion in 2026 before reaching an all-time high in 2027.

Ajit Manocha, President and CEO of SEMI, remarked on the projections, stating, “The increase in 300mm fab equipment spending underscores the pressing need for production capacity to meet the escalating demand for electronics across diverse markets, fueled by advancements in artificial intelligence (AI) innovation.”

Regionally, China is poised to maintain its lead in fab equipment spending, with $30 billion investments annually over the next four years, driven by government incentives and policies promoting domestic self-sufficiency. Taiwanese and Korean chip suppliers are also ramping up equipment investments, with Taiwan projected to rank second at $28 billion in 2027, and Korea following closely at $26.3 billion.

The foundry segment is expected to experience a slight decline in spending this year, attributed in part to the anticipated slowdown in mature node investments. However, the segment remains resilient, driven by demand for generative AI, automotive, and intelligent edge devices.

Memory technology, particularly high-bandwidth memory (HBM), is witnessing increased investment, driven by the demand for greater data throughput essential for AI servers.

Analog, Micro, Opto, and Discrete are projected to witness growth in 300mm fab equipment investments by 2027.

TelecomLead.com News Desk