A TrendForce report highlights a sustained weakness in consumer demand for memory products through Q3 2024, with AI servers now being the primary growth engine for memory demand.

This shift has prompted suppliers to maintain a firm stance on raising contract prices, particularly for HBM (High Bandwidth Memory), which is encroaching on conventional DRAM production capacity.

DRAM Market Developments

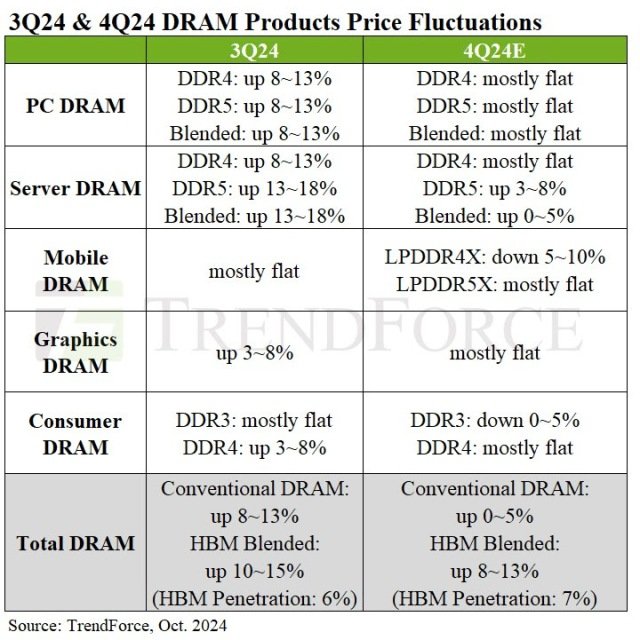

Conventional DRAM Price Growth Slows: As AI server demand remains strong, memory prices are expected to increase more slowly in Q4. While conventional DRAM prices are projected to rise by only 0–5 percent, HBM’s increasing share will cause the overall DRAM market average to climb by 8–13 percent. This marks a deceleration from the previous quarter’s faster growth.

PC DRAM Prices Stabilize: The PC DRAM market is expected to remain flat through Q4, with weak consumer demand and cautious OEM inventory strategies. Despite efforts to push prices up, the impact of HBM production displacing traditional DRAM capacity will be tempered by ongoing hesitancy in the PC market.

Server DRAM Prices Increase Slightly: After reduced procurement in Q3 by U.S.-based cloud service providers, demand is expected to rebound in Q4. TrendForce anticipates a modest 0–5 percent price increase, fueled by improved DDR5 shipments.

Mobile and Graphics DRAM Markets

Mobile DRAM Declines: Smartphone manufacturers have scaled back mobile DRAM purchases, resulting in a 30 percent drop in demand in Q3. LPDDR4X prices are forecasted to decline by 5–10 percent in Q4, while LPDDR5X prices are expected to remain stable due to healthier inventory levels.

Graphics DRAM Steady: With demand in the graphics DRAM market remaining weak, Q4 prices are expected to remain flat, despite a slight increase in orders from VGA card makers.

Consumer DRAM Market Weakness

Consumer DRAM Prices Under Pressure: DDR3 prices could decline by 0–5 percent in Q4 due to oversupply and weaker demand, especially as Taiwanese manufacturers expand capacity. DDR4 prices are likely to remain stable but face the possibility of a drop given increased production from Chinese suppliers.