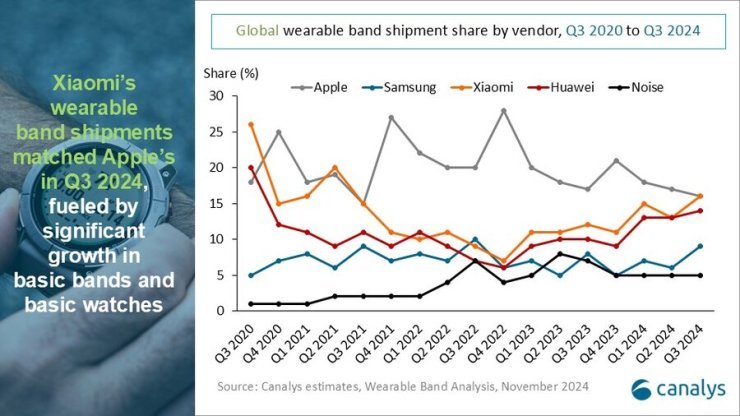

The global wearable band market expanded by 3 percent year-over-year in Q3 2024, reaching 52.9 million units, according to the latest Canalys report.

Growth was observed across all categories: basic bands, basic watches, and smartwatches. Notably, the basic band segment rebounded after three years, growing by 7 percent with 10.4 million units shipped. This resurgence was driven by launches like Xiaomi’s Mi Band 9 and Samsung’s Galaxy Fit3.

The basic watch segment, while still growing, saw a modest 3 percent increase, reaching 23.9 million units, amid slowing demand in India. Smartwatch shipments grew slightly by 0.1 percent to 18.5 million units, with Huawei and Samsung compensating for Apple’s decline in shipments.

Xiaomi Leads with Diversified Offerings

Xiaomi achieved its highest shipment figures since Q4 2020, propelled by the Mi Band 9 and Redmi Watch 5 series. The company has targeted multiple price segments by introducing diverse versions, such as Pro, NFC, and Active models. While this strategy boosted volume, it caused a 9 percent decline in Xiaomi’s average selling price (ASP). However, the premium Watch S series reported an impressive 70 percent growth.

“Xiaomi’s broad portfolio strategy has strengthened its position in emerging markets,” said Jack Leathem, Research Analyst at Canalys. “Balancing entry-level offerings with premium aspirations remains a critical challenge for the company.”

Emerging Markets Drive Growth

Regional disparities continued to shape market dynamics. Emerging markets, including Latin America and EMEA, exhibited strong growth, spurred by affordable offerings like Xiaomi’s bands and Samsung’s Galaxy Fit3. In contrast, North America faced declining demand due to waning interest in Apple’s legacy models and Fitbit’s shrinking share.

“Emerging markets provide significant opportunities for vendors to expand through cost-effective devices,” said Cynthia Chen, Research Manager at Canalys. “In mature markets like North America, vendors face difficulties driving upgrades due to a lack of compelling new features.”

Smartwatches Key to Premiumization

Despite accounting for just 35 percent of shipments, smartwatches contributed 74 percent of the market value in Q3 2024. Advanced features like AMOLED displays and dual-processor architectures have heightened competition in the segment.

“Vendors must continue to innovate in hardware and software, focusing on premiumization and ecosystem integration to capture higher market value,” Leathem added.