The latest Omdia report prepared by David Hsieh, Senior Research Director, Displays, Omdia, has highlighted strategies of major players in the OLED market.

# Samsung Display

Maintain Leadership in Innovation

Pioneer new OLED form factors such as stretchable and foldable designs.

Invest in Micro LED development to diversify display offerings and compete with emerging technologies.

Advance Production Technologies

Implement Gen8.6 fabs and mask-less OLED photolithographic processes to enhance efficiency and reduce costs.

Expand Applications

Target AR/VR and automotive displays to secure a larger share of high-growth segments.

Collaborate with tech manufacturers to integrate OLED into emerging device categories.

# LG Display

Diversify into FAST-Growing Applications

Focus on automotive OLED displays and OLED use in AR/VR headsets.

Emphasize lightweight, slim, and energy-efficient designs to capture wearables and portable devices markets.

Innovate Hybrid Displays

Develop hybrid OLED and Tandem RGB OLED technologies to increase brightness and longevity.

Challenge Competitors with Micro LED

Accelerate research and development of stretchable Micro LED displays for next-generation applications.

# BOE (China)

Scale Production Capacity

Expand Gen8.6 fab operations to increase OLED output and reduce unit costs.

Leverage China’s manufacturing ecosystem for economies of scale.

Dominate Smartphone Displays

Strengthen partnerships with global smartphone manufacturers to sustain leadership in small to medium OLED displays.

Invest in Future Technologies

Explore advanced material technologies to improve display flexibility and durability.

# Visionox, ChinaStar, EverDisplay, and Tianma (China)

Collaborate for Market Penetration

Pool resources to develop advanced OLED technologies, including inkjet printing and LTPO+ backplanes.

Partner with global and regional device makers to expand market share.

Explore Niche Markets

Focus on applications such as industrial displays, head-mounted displays, and sub-displays for wearables.

# AUO (Taiwan)

Accelerate Micro LED Initiatives

Scale up production of small to medium Micro LED displays to compete in emerging segments.

Balance OLED and Micro LED Investments

Continue refining OLED technology while introducing competitive Micro LED products to diversify offerings.

# Global Strategy: Competition vs. Collaboration

Foster Co-Innovation Across Borders

Form cross-border partnerships to share R&D investments and accelerate the commercialization of innovative OLED solutions.

Balance collaboration with internal innovation to stay competitive.

By executing these strategies, major players can sustain their competitive edge, expand into new markets, and navigate challenges posed by emerging technologies like Micro LED.

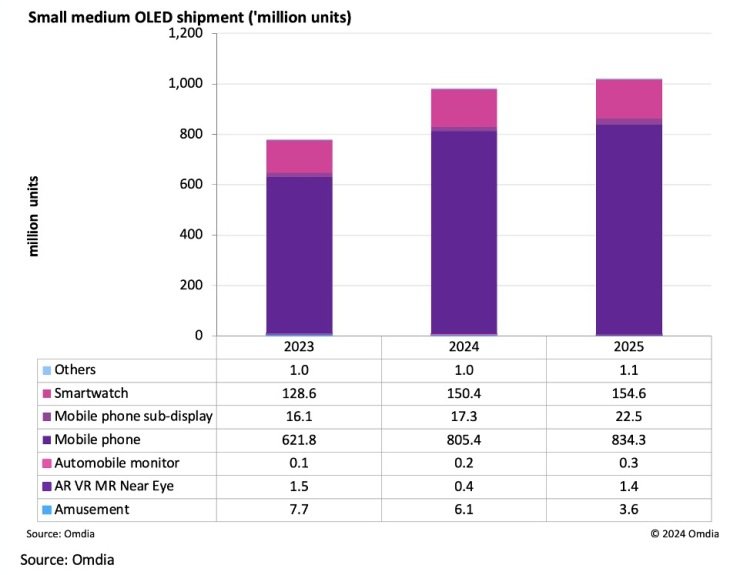

“Despite its higher cost and more complex manufacturing, OLED has proven ideal for small to medium displays due to its slim design, lightweight, excellent picture quality, efficient power consumption and flexibility. Beyond replacing TFT LCDs in these applications, OLED enables innovative form factors like ultra-lightweight and foldable designs. Shipments of small to medium OLED display are projected to peak 1 billion units in 2025,” David Hsieh, Senior Research Director, Displays, Omdia, said.

OLED Display Market

Small to medium OLED shipments (1–8 inches) are projected to surpass 1 billion units for the first time by 2025.

Applications include smartphones, AR/VR headsets, smartwatches, automotive displays, and more.

OLED’s superior features: slimness, lightweight design, color saturation, contrast, and flexibility.

Innovations like Gen8.6 fabs, LTPO+ backplane, under-display cameras, and inkjet printing are improving production efficiency.

Market drivers include strong contributions from Chinese manufacturers (BOE, Visionox, Tianma) and Korean giants (Samsung Display, LG Display) and expansion into new fields like AR/VR and automotive displays.

Higher costs and complex manufacturing remain hurdles for OLED technology. Competition from emerging Micro LED technology, which offers stretchability and reduced costs, is growing.

OLED is expected to dominate small to medium display markets for decades, despite potential competition from Micro LED.

OLED innovations, including foldable and hybrid designs, continue to push boundaries in display technology.

Baburajan Kizhakedath