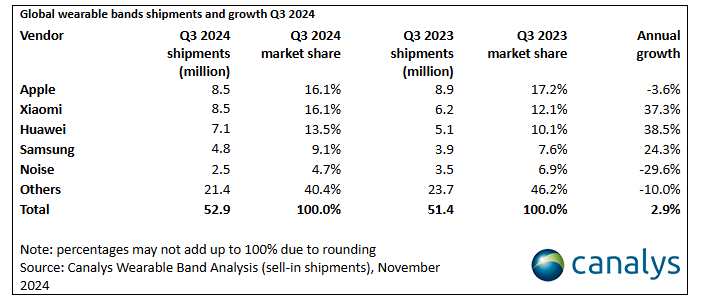

The global wearable band market grew 3% year-on-year in Q3 2024, reaching 52.9 million units, according to Canalys. Growth was observed across all three categories—basic bands, basic watches, and smartwatches.

The global wearable band market grew 3% year-on-year in Q3 2024, reaching 52.9 million units, according to Canalys. Growth was observed across all three categories—basic bands, basic watches, and smartwatches.

Notably, the basic band segment rebounded with 10.4 million units shipped, a 7% year-on-year increase, driven by Xiaomi’s Mi Band 9 and Samsung’s Galaxy Fit3. Basic watches grew by 3% to 23.9 million units, while smartwatches experienced marginal growth of 0.1%, reaching 18.5 million units as gains by Huawei and Samsung offset Apple’s decline.

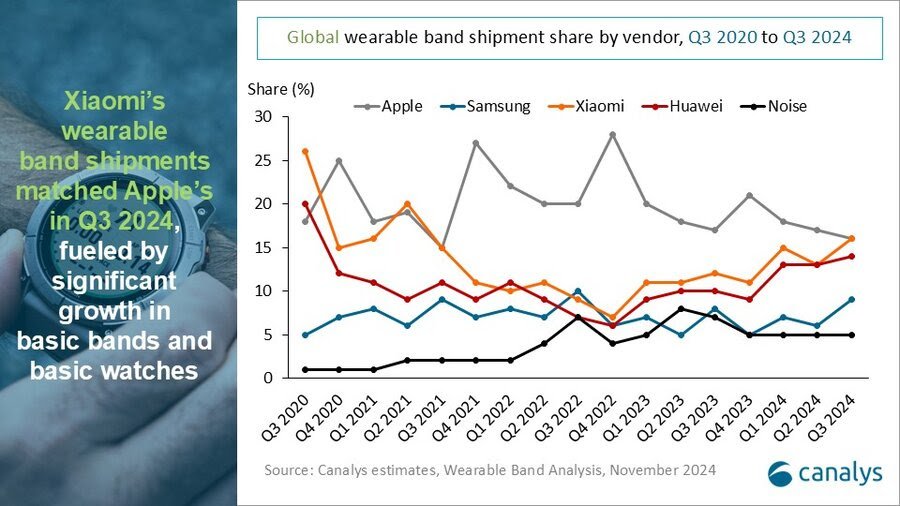

Xiaomi matched Apple as the top vendor, shipping 8.5 million units, its highest volume since Q4 2020. Strong demand for the Mi Band 9 and Redmi Watch 5 series, along with diverse product variants, boosted its performance. However, Xiaomi’s emphasis on entry-level products caused its average selling price (ASP) to fall 9% year-on-year. Huawei saw the strongest growth at 38.5%, while Samsung increased shipments by 24.3%.

Emerging markets drove growth, with Xiaomi and Samsung performing strongly in Latin America and EMEA regions. In contrast, North America struggled due to declining demand for Apple’s older models and Fitbit’s waning presence.

Smartwatches accounted for just 35% of total shipments but captured 74% of market value, underscoring their importance for vendors pursuing premiumization and ecosystem strategies. Vendors are increasingly adopting advanced features like AMOLED displays, dual-processor architecture, and enhanced tracking to appeal to consumers.

Canalys emphasized the need for innovation and premium-focused messaging to maintain competitiveness in a market with intensifying price pressures and evolving consumer expectations.