TrendForce unveils projections for the 2024 DDIC market, painting a picture of both promise and complexity. The preceding year, 2023, witnessed a stabilization in prices or minor decreases, setting the stage for a transformative transition in the year ahead.

Anticipated is a sweeping surge in demand, particularly for expansive applications such as TVs, gaming monitors, and commercial notebooks, foretelling a significant upswing in panel shipments and, consequently, a spike in DDIC demand. However, despite this promising surge, the market foresees a continued downward trajectory in DDIC prices due to enduring market pressures.

Reflecting on the trends of 2023, TrendForce highlights the resurgence in TV panel prices, which momentarily alleviated the strain on panel manufacturers. However, the ongoing pressure to slash costs from upstream component suppliers persisted, compelling DDIC suppliers to revamp product designs strategically to drive cost efficiency. Establishing stronger ties with more economical foundries emerged as a strategic imperative in navigating this landscape.

At present, Chinese foundries have emerged as prominent players, leveraging government-backed initiatives to aggressively expand production capacities. Their competitive pricing strategies have magnetized DDIC suppliers, prompting a significant shift in market dynamics.

Since the latter half of 2023, these foundries have operated at maximum capacity, fueled by peak season demand, and are further bolstering their production capabilities. In contrast, Taiwanese 8-inch foundries are grappling with a more challenging market, resorting to less competitive pricing strategies, leading to a stark drop in utilization rates to 50 percent.

The onset of 1Q24 heralds a traditional market lull, prompting major panel makers to adhere to conservative capacity control measures to avert overproduction and potential declines in panel prices. Simultaneously, a downturn in front-end component procurement is anticipated. However, the subsequent quarter looms as a pivotal test phase, as an anticipated surge in end-user demand may incite panel makers to escalate procurement, potentially disrupting the supply-demand equilibrium.

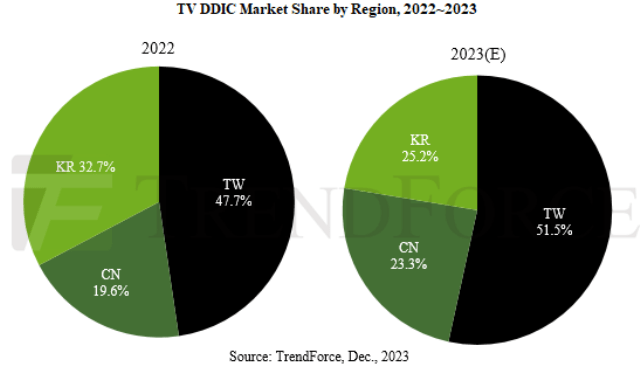

Of paramount significance is the concentration of panel production in Chinese facilities, alongside China’s accelerated push for domestic component manufacturing. This paradigm shift exerts substantial pressure on Taiwanese suppliers, historically dominant in the DDIC market.

They face multifaceted challenges encompassing pricing, technological prowess, strategic positioning, and market share. Responding to this shift, Taiwanese suppliers are intensifying efforts in technological innovation and robust R&D investments to match the escalating demand for cutting-edge display technology, fortify brand identity, and solidify their foothold in the market.