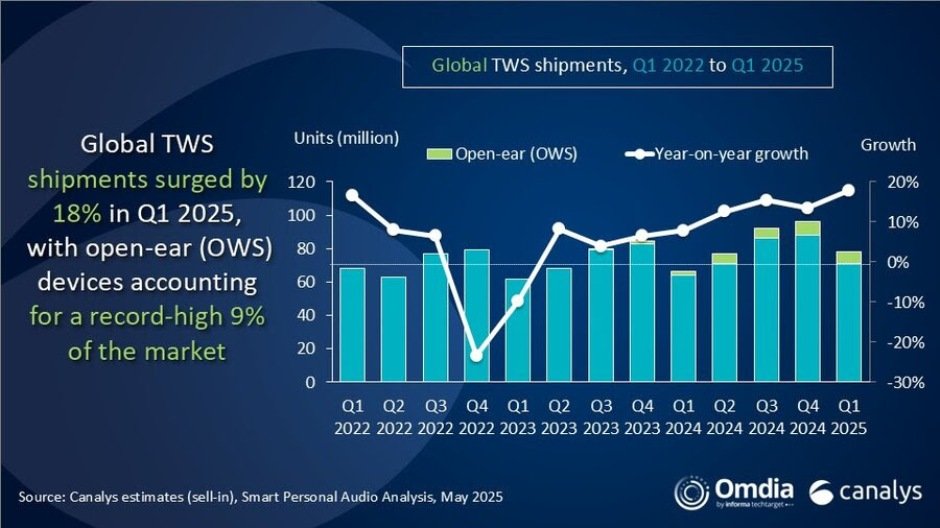

The global true wireless stereo (TWS) market has made a notable comeback in Q1 2025, with shipments rising by 18 percent year-on-year to 78 million units, marking the sector’s strongest growth since 2021.

The rebound, highlighted in a recent Canalys (now part of Omdia) report, underscores a pivotal moment for the industry — one defined by ecosystem integration, expanding geographical footprints, and an evolution from utility-based products to lifestyle-centric wearables.

Ecosystem Strategy Drives Market Leadership

Apple’s continued dominance, capturing 23 percent of the global market, reinforces the power of a tightly integrated hardware-software ecosystem. By embedding health features and leveraging its existing device portfolio, Apple has secured a stronghold, particularly in North America where it commands over 50 percent market share. However, the report also signals that the broader U.S. market’s growth — fueled in part by tariff-driven inventory strategies — remains vulnerable due to regulatory uncertainty and waning consumer appetite for budget offerings.

Xiaomi’s 63 percent year-on-year growth, propelling it to second place, exemplifies the strength of aggressive geographic and demographic expansion. Its performance in emerging economies showcases a well-calibrated strategy: offer cost-effective yet feature-rich devices, backed by expanding after-sales networks and brand visibility. Xiaomi’s market share milestone of 11.5 percent reflects its transition from a value brand to a mainstream player.

Shifting Competitive Dynamics and Strategic Moves

Samsung, Huawei, and India’s boAt round out the top five, each contributing to the sector’s renewed momentum. Samsung’s dual focus on the premium Galaxy Buds and JBL’s mass-market appeal helps it maintain relevance across consumer segments. Notably, Samsung’s Harman division acquiring Sound Units and Bowers & Wilkins suggests an impending push into higher-end audio, signaling consolidation and brand elevation as key themes moving forward.

Huawei’s strength in emerging markets and boAt’s continued performance highlight how localized strategies — tailored to price-sensitive consumers and distribution-specific needs — are reshaping the competitive map. Both brands are instrumental in displacing generic white-label manufacturers, raising the entry barrier for new players.

OWS: The Next Growth Vector

A standout development is the rise of open-ear wearable stereo (OWS) devices, which are increasingly driving innovation and consumer engagement. These devices, combining fashion aesthetics with functional audio, are outpacing traditional TWS growth. As Cynthia Chen from Canalys notes, OWS is transforming earbuds into expressions of personal style — complete with decorative enhancements and material experimentation.

Importantly, the audio quality gap is narrowing, as emerging players partner with sound labs to improve performance. This design-centric innovation indicates that the future of TWS lies not only in technical specs but also in emotional and stylistic resonance with consumers.

Outlook: Beyond Price, Toward Experience

The broader takeaway from Q1 2025’s performance is that the TWS market is evolving from price-driven volume games to experience-centric ecosystems. The next phase of competition will revolve around scenario-based functionality — AI-powered assistants, fitness tracking, real-time translation — and integrated service ecosystems that blend hardware, software, and content.

To thrive, brands must move beyond commoditization and embrace vertical integration, unique use-case development, and premium product lines. The shift toward dual-form factor portfolios (TWS and OWS) is just the beginning. Long-term winners will be those who can innovate consistently while addressing diverse lifestyle needs — from wellness and productivity to entertainment and fashion.

Q1 2025 marks a turning point for the TWS market. The blend of strong ecosystem strategies, geographic expansion, and lifestyle-oriented product design suggests a maturing industry with room for premiumization and differentiation. As the line between consumer tech and fashion continues to blur, TWS brands must innovate not just in function, but in form, meaning, and experience.

Rank changes

Apple maintained its leadership position with 18.2 million units shipped, although its market share slightly declined from 24.4 percent in Q1 2024 to 23.3 percent in Q1 2025, indicating that while shipments rose, competitors expanded more aggressively.

Xiaomi emerged as a strong performer, nearly doubling its shipments from 5.5 million to 9.0 million units. This propelled its market share from 8.3 percent to 11.5 percent, reflecting successful market penetration and possibly improved product offerings or competitive pricing strategies. Samsung also saw a modest increase in volume, shipping 5.6 million units compared to 5.2 million in the previous year, though its market share dipped slightly from 7.8 percent to 7.1 percent, suggesting it grew but not as rapidly as the market overall.

Huawei experienced growth in both shipments and share, climbing from 3.4 million units and a 5.1 percent share in Q1 2024 to 4.7 million units and a 6.0 percent share in Q1 2025. boAt, a key player in emerging markets, particularly India, shipped 3.9 million units, up from 2.9 million the year before, increasing its share from 4.4 percent to 4.9 percent. These gains highlight rising brand recognition and possibly effective regional marketing.

The “Others” category, which includes smaller brands and newer entrants, remains significant with 36.9 million units shipped. However, despite a volume increase from 33.2 million, its market share shrank from 50.0 percent to 47.2 percent, indicating consolidation among top brands as they capture a larger piece of the expanding pie. Overall, while the total shipment volume increased substantially, shifts in market share reveal dynamic competition, with newer and regional players gaining traction while established giants like Apple strive to maintain dominance amid intensifying rivalry.

Baburajan Kizhakedath