Telecom and pay-TV services revenue in Singapore is anticipated to witness a decline — at a compound annual growth rate (CAGR) of 0.2 percent between 2023 and 2028. There will be a surge in subscriptions for mobile data and fixed broadband segments in Singapore, GlobalData said.

The latest report, “Singapore Telecom Operators Country Intelligence Report” by GlobalData, indicates a probable increase in total mobile subscriptions with a CAGR of 1.4 percent over the next five years in Singapore. This growth aligns with the continuous surge in mobile internet subscriptions, widespread adoption of smartphones, escalating multi-SIM usage, and the expansion of M2M/IoT subscriptions within the nation.

The latest report, “Singapore Telecom Operators Country Intelligence Report” by GlobalData, indicates a probable increase in total mobile subscriptions with a CAGR of 1.4 percent over the next five years in Singapore. This growth aligns with the continuous surge in mobile internet subscriptions, widespread adoption of smartphones, escalating multi-SIM usage, and the expansion of M2M/IoT subscriptions within the nation.

Aasif Iqbal, a Telecom Analyst at GlobalData, highlights, “Fixed broadband subscriptions in Singapore are expected to experience a 1.8 percent CAGR over the forecasted period. This growth will be propelled by the ongoing rise in FTTH/B subscriptions, backed by governmental initiatives aimed at bolstering and modernizing fiber broadband connectivity nationwide.

Operators like Netlink NBN Trust are gearing up to intensify investments in expanding and densifying fiber network coverage, aiming to bring outdoor sites closer to fiber readiness from the nearest fiber node.

IPTV emerges as the solitary platform set to deliver pay-TV services in Singapore throughout the forecast period. Nevertheless, IPTV subscriptions are forecasted to decline at a negative CAGR of 5.3 percent from 2023 to 2028 due to the accelerated shift of customers towards Over-The-Top (OTT) services in Singapore.

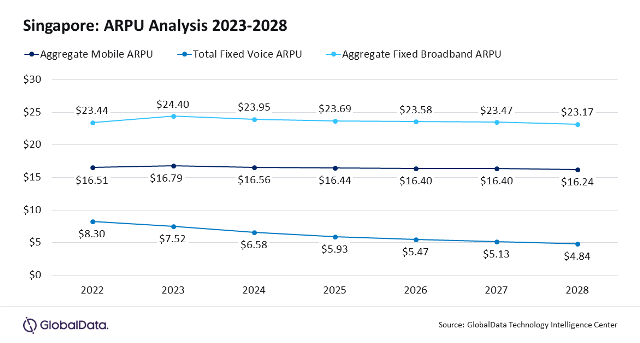

Despite the expected rise in subscriptions for mobile and fixed broadband segments, the revenue generated from these domains, including fixed voice and pay-TV segments, is anticipated to dwindle. This decline is attributed to a consistent decrease in Average Revenue Per User (ARPU) levels across mobile, fixed, and pay-TV services. The reduction is spurred by competitive pricing strategies and discounts offered by service providers.

Singtel is anticipated to maintain its dominant market share across mobile, fixed voice, fixed broadband, and pay-TV segments in 2023. The company’s stronghold in the mobile sector stems from its robust presence in both prepaid and postpaid segments.

Singtel is focusing on intensifying its 5G network development and expansion efforts to sustain its competitiveness in the mobile market. Additionally, in the fixed broadband domain, Singtel’s prominence is supported by its substantial presence in the FTTH/B segment and its strategy of promoting discounted fixed broadband plans coupled with supplementary perks.

While mature mobile service providers could pivot towards service diversification and capitalize on M2M/IoT opportunities for growth, players in the fixed broadband sector are expected to concentrate on expanding and upgrading fiber broadband services in Singapore.

Moreover, innovative pricing models and bundled plans are poised to be key drivers for growth. For the declining pay-TV service sector, operators might need to fortify their content libraries and introduce competitive pricing strategies to combat the burgeoning competition from OTT service platforms and retain relevance in Singapore telecom market.