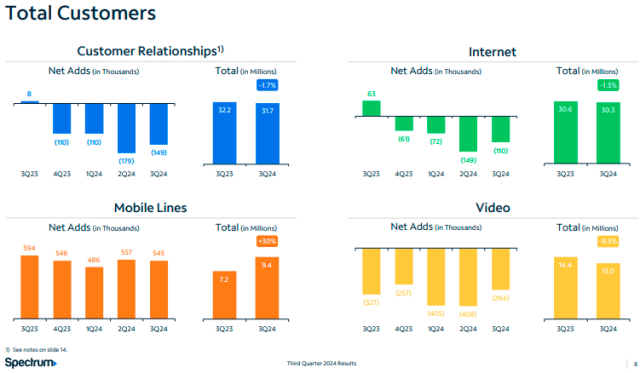

Charter Communications’ (Spectrum) Q3 2024 financial result has indicated significant drop in Internet customers during the quarter.

Internet customers decreased by 110,000, bringing the total to 30.3 million. This drop was due to the end of the FCC’s Affordable Connectivity Program.

Mobile lines grew by 545,000, reaching 9.4 million lines.

Video subscribers decreased by 294,000, totaling 13.0 million.

Wireline voice customers fell by 288,000, ending at 7.2 million.

Spectrum Internet has launched symmetrical Internet service in eight markets, aiming to expand multi-gigabit speeds across its network.

Spectrum Advanced WiFi now offers optimized, secure home networks for all Spectrum Internet customers.

Spectrum Mobile’s growth aligns with Charter’s converged network strategy, offering competitive 5G plans with transparent pricing and no contracts.

Spectrum TV Select customers will soon receive up to $80/month in programmer streaming applications (ad-supported versions) such as Max, Disney+, Peacock, and more, adding value without extra cost.

Q3 revenue increased by 1.6 percent to $13.8 billion, driven by growth in mobile service, internet, advertising, and other revenues, partly offset by a decline in video revenue.

Residential revenue was up 0.3 percent, totaling $10.8 billion, with an average monthly revenue per residential customer rising to $121.47.

Internet revenue rose 1.7 percent to $5.9 billion, supported by promotional rate increases, while video revenue fell 6.7 percent to $3.7 billion due to customer losses and more affordable video packages.

Mobile service revenue saw significant growth, up 37.6 percent to $801 million, thanks to an increase in mobile lines.

Advertising revenue grew 18.1 percent year-over-year, largely due to political advertising, while commercial revenue increased 2.0 percent year-over-year to $1.8 billion, with growth in both enterprise (3.7 percent) and SMB (1.0 percent) revenues.

Other revenue reached $756 million, an 11.6 percent increase, driven by mobile device sales.

Q3 capital expenditures totaled $2.6 billion, a decrease of $398 million from Q3 2023, due to reduced spending on customer premise equipment (CPE) and network upgrades.

Charter spent $200 million for Network Evolution, $1.1 billion for Line Extensions and $1.3 billion for Core Capex during the third-quarter.

Charter revised its 2024 capital expenditure forecast down to $11.5 billion (from $12 billion), due to lower projected network evolution costs and line extension spending, with a focus on plant restoration following hurricanes.

Outlook on Capital Allocation:

2024 network evolution spending is expected to be around $1.1 billion (down from $1.6 billion) due to delays in software certification.

Line extension spending is now projected to be $4.3 billion (down from $4.5 billion) due to resource reallocation for hurricane recovery efforts.

These results highlight Charter’s strategy to grow mobile and internet services while adapting its capital spending to network needs and environmental factors, such as recent hurricanes.

Baburajan Kizhakedath