Telecom operators in Malaysia have transitioned to 5G, with network rollout and customer adoption accelerating, GSMA Intelligence said in its recent report.

The government has granted a second nationwide 5G licence to U Mobile, an operator with around 20 percent market share in Malaysia, removing what was in effect an infrastructure monopoly and paves the way for a dual network model.

The move to a 5G dual-network (DN) model is the right one for customer choice, long-term financial sustainability and Malaysia’s competitiveness as a tech and services economy. However, challenges remain, including the need to ensure market stability, regulatory clarity and long-term investment incentives. Guaranteeing market stability and certainty should be the number one priority to unlock substantial investments and drive Malaysia towards a successful digital future.

This follows a relatively slow start as a result of delays to 5G licensing and the eventual creation of the single wholesale network (SWN) originally provisioned to Digital Nasional Berhad (DNB) – the state-owned entity.

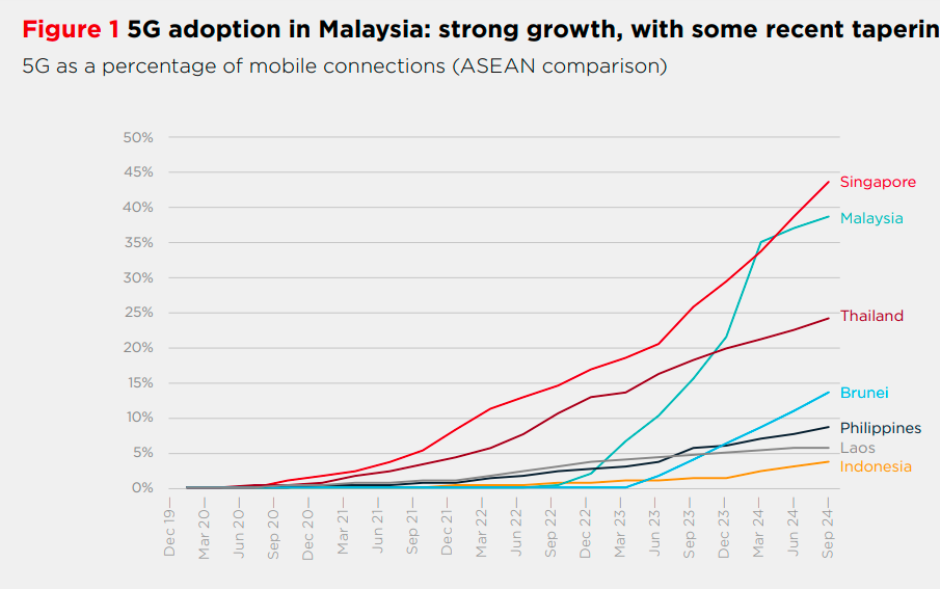

5G adoption in Malaysia has now reached around 40 percent of mobile connections. China, Japan and South Korea remain the vanguard nations in Asia; all record penetration rates of more than 50 percent, in line with the US and a handful of European countries.

Malaysia’s run rate of incremental 5G subscriber growth – around 5 percentage points (pp) per quarter in 2024 – has been in line with Singapore, and faster than Thailand and India, where mobile operators have made concerted efforts to migrate 4G subscribers at pace. While some of the growth reflects playing catch-up following initial delays to rollouts, it also signals bona fide consumer demand – typically a positive indicator for subsequent monetisation.

Investment

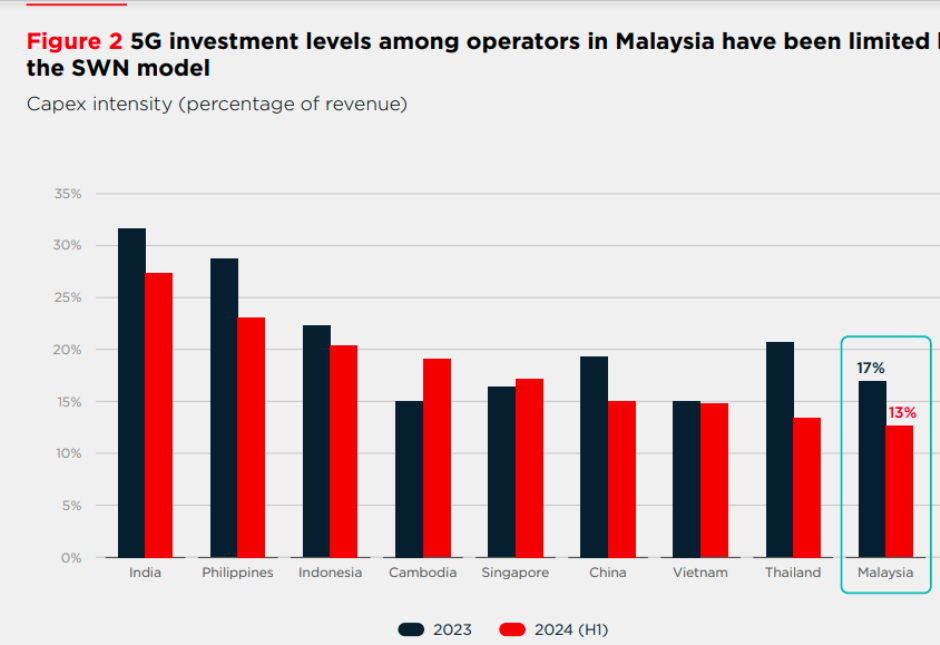

The telecoms sector records 15–20 percent capex intensity overall over a 10-year infrastructure cycle. The rate moves to the high end in the early stages (as base stations are built and fibre is laid for backhaul) and to the low end in the latter stages, once the infrastructure is in place and before the next cycle (6G) begins.

Although Malaysia has grown 5G adoption, infrastructure investment in 5G networks has been lower than among its peer group. In 2023, Malaysian operators spent around 12 percent of their revenues on capex. DNB’s estimated investment brings the sector total to 17 percent overall.

Capex of telecom operators in Malaysia has tapered off in 2024, with the incremental rate of population coverage slowing and a commensurate slowdown in the growth of 5G adoption. The underinvestment limits what would otherwise be faster 5G adoption in a multi-network model, together with service innovation that plays on the 5G network capabilities and (ultimately) economic diversification.

Main operators

The market structure in Malaysia comprises five players, but three companies – CelcomDigi, Maxis and U Mobile – account for more than 90 percent of subscribers and revenues.

CelcomDigi holds the largest share of mobile subscribers in Malaysia at 47 percent, contributing 42 percent to the total revenue and utilizing 22 percent of the total spectrum.

Maxis follows with 26 percent of mobile subscribers, generating 35 percent of total revenue while holding 13 percent of the total spectrum.

U Mobile accounts for 20 percent of subscribers, but its revenue share is not reported, while it utilizes 26 percent of the spectrum.

Yes commands a 4 percent subscriber share, 4 percent of total revenue, and 7 percent of the spectrum.

Telekom Malaysia has a 2.6 percent subscriber share, 1.3 percent revenue share, and 8 percent of the total spectrum. DNB’s subscriber and revenue shares are not applicable, but it holds 16 percent of the spectrum. The remaining operators under “Other” contribute 0.4 percent to subscriber share and hold 8 percent of the spectrum.

Digital focus

Malaysia has actively attracted global investments. In 2023, Nvidia partnered with YTL Power on a $4.3 billion AI infrastructure project, marking a major milestone.

US tech giants have committed over $10 billion to cloud infrastructure investments in Malaysia, with Amazon pledging $6.2 billion, Microsoft $2.2 billion, and Google $2.0 billion in data centres and cloud services to support AI initiatives.

Malaysia’s rapid expansion in the data centre industry is evident in DC Byte’s 2024 Global Data Centre Index, which named Johor Bahru the fastest-growing data centre market in Southeast Asia.

The country has also made strides in future-proofing its internet infrastructure, emerging as a global leader in IPv6 adoption. As of December 2024, Malaysia ranked fourth in the Google IPv6 Country Rank, trailing only France, Germany, and India.

GSMA Intelligence’s authors include Tim Hatt, Head of Research and Consulting Pau Castells, Head of Economic Analysis Kenechi Okeleke, Senior Director, Regional Social and Policy Research.

Baburajan Kizhakedath