Worldwide Radio Access Network (RAN) market is expected to grow a 0 percent CAGR over the next five years, according to Dell’Oro Group.

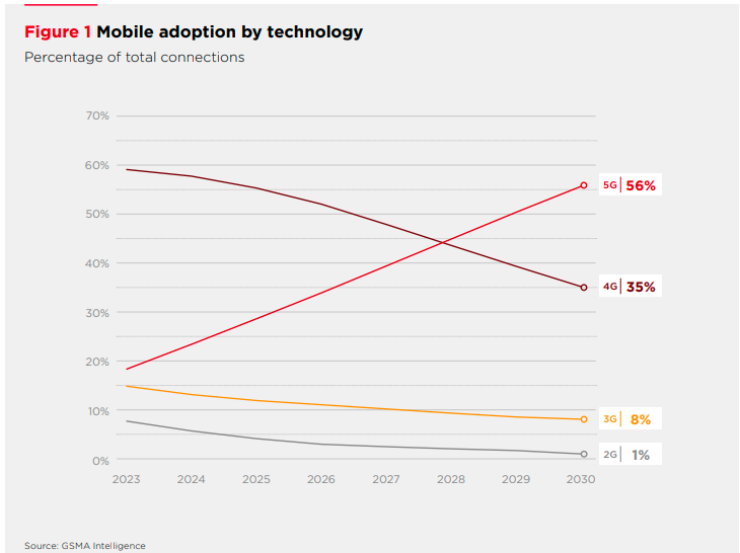

Regional 5G coverage imbalances, slower data traffic growth, and monetization challenges are negatively impacting the market, Dell’Oro Group said. 5G subscribers accounted for nearly 20 percent of total connections in 2023, according to GSMA Intelligence.

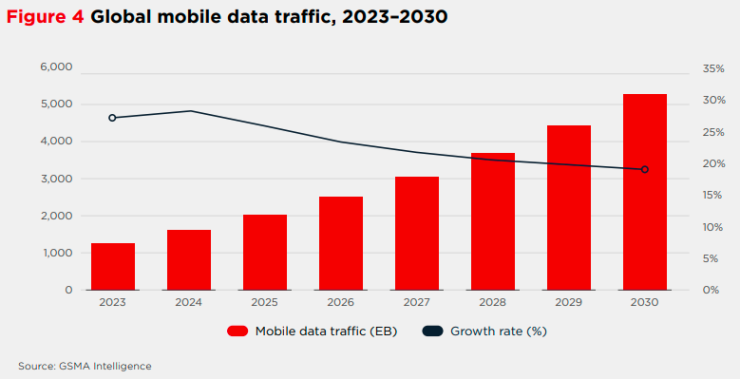

GSMA Intelligence report earlier indicated that mobile data traffic rose from an average monthly usage level per connection of 10.2 GB in 2022 to 12.8 GB in 2023.

The six-fold increase in data traffic projected between now and 2030 has significant implications for operators. The most immediate challenge is to allocate capex funds for the acquisition of new spectrum and deployment of additional base stations in the RAN, to increase coverage and capacity at the network access layer.

“However, RAN upgrades alone will not alleviate the capacity crunch for operators. Upgrades are also required for the backhaul and underlying transport layers of the network, as well as the core network as operators migrate from 4G and other legacy networks to 5G standalone (5G SA) and 5G-Advanced,” GSMA Intelligence said.

“Regional imbalances will impact the market over the short term while the long-term outlook remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group, said.

As the investment focus of mobile operators gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth, Dell’Oro Group said.

In mature markets, Finland records average monthly data use per connection of just above 50 GB, while the US records around 39 GB per month.

In emerging markets, India recorded average monthly mobile data use of 20.3 GB per connection in Q1 2024, while China and Indonesia recorded 18.6 GB and 13.7 GB, respectively, GSMA Intelligence said.

The mix between existing and new use cases has not changed, Stefan Pongratz said. Private/enterprise RAN is expected to grow at a 20 percent plus CAGR while public RAN investments decline.

5G-Advanced will play an essential role in the 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

Baburajan Kizhakedath