GSMA Intelligence has shared strategies for mobile operators to tap the opportunity in B2B technology services.

With slow ARPU growth in mobile and fixed connectivity, telecom operators are focusing on diversifying revenues, particularly through B2B technology services. These non-core telecom services made up 26 percent of operator revenues in 2022, rising from 18 percent in 2019.

B2B technology services, fueled by digital transformation, are seeing faster growth than B2C. Operators are meeting enterprise demand for integrated technology solutions across areas like cloud, edge, IoT, and security.

GSMA Intelligence estimates a $400 billion addressable market for telecom operators in B2B tech services, representing around 35 percent of the global mobile operator revenue base.

In 2023, financial services ($59 billion), manufacturing ($61 billion), automotive ($22 billion), and aviation ($16 billion) represented large addressable segments, with strong growth projections (CAGRs of 8.4 percent-12.1 percent) expected through 2030. These industries make up roughly one-third of the total B2B technology services market for telecom operators.

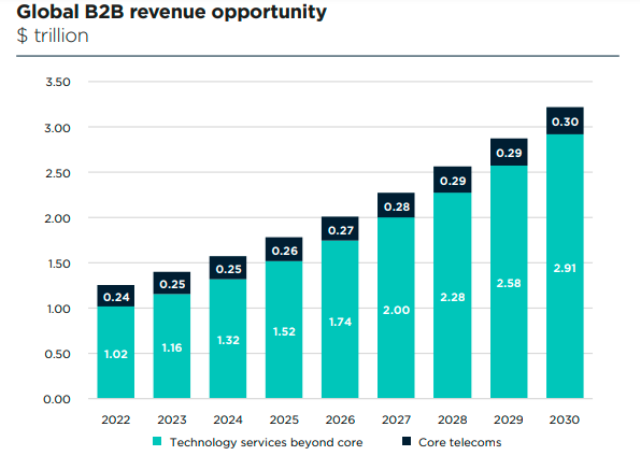

The revenue potential for B2B technology services beyond core telecoms is expected to reach $2.9 trillion by 2030, growing significantly faster than core telecoms revenue.

Telecom operators could capture nearly $1 trillion, or 34 percent, of the B2B technology services market by 2030.

Manufacturing, financial services, aviation, and automotive industries represent 37 percent of the addressable B2B technology services market.

The manufacturing sector’s B2B technology services market, driven by edge, cloud, and AI/ML applications (e.g., preventive maintenance, digital twins, asset tracking), is expected to grow at a CAGR of 12.1 percent, reaching $136 billion by 2030.

Financial services offer substantial B2B technology opportunities in cloud, edge, and cybersecurity, with projected growth at a CAGR of 10.9 percent, reaching $122 billion by 2030.

Core telecom services include SD-WAN, edge networking, private wireless networks, traditional mobile and fixed voice/data, and unified communications tools like IP VPNs and web conferencing.

Beyond Core Telecom – Technology Services include Cloud & Data Centers; Cybersecurity; IoT Services and other technologies such as Big data, AI services, blockchain, and network APIs.

The enterprise market, with a growth rate of 5.6 percent in 2022, is outpacing the consumer segment’s growth of 1.5 percent, driven by enterprises’ need for digital transformation and efficiency.

To capitalize on 5G, operators must expand beyond consumer connectivity and focus on advanced solutions like network slicing and private networks, with a long-term shift towards comprehensive enterprise-focused solutions and integration capabilities.

Core telecoms make up about 70 percent of B2B revenue but are growing slowly and facing increased competition from AWS Cloud WAN, Microsoft’s Azure Virtual WAN, and similar services.

To drive growth, operators must go beyond traditional connectivity, focusing on technology services such as cloud computing and cybersecurity. This expansion into technology services, along with partnerships and new verticals, allows operators to support enterprises’ digital transformation and establish a stronger B2B presence.

36 percent of operators in the GSMA Intelligence survey see market leadership in both enterprise connectivity and services as their primary goal, indicating a move toward bundled solutions tailored for enterprise needs. European operators, in particular, prioritize this combined approach.

North American operators are focused on maximizing returns on network investments, with a current emphasis on financial outcomes and strong engagement with enterprises in connectivity + services.

CASE STUDIES

Telefonica Tech

Telefonica Tech has developed an automated onboarding platform for Virgin Money using Microsoft Power Platform, streamlining the client acquisition process with minimal customer input.

Since implementing the new platform, Virgin Money’s customer acquisition rate rose from 5 percent to 34 percent, driven by a faster and more user-friendly application process.

The average time to complete an application was cut down to 10–25 minutes.

Currently, 20 percent of customers use the new portal for onboarding, with half of new accounts being opened within five days of application.

Telefonica Tech’s financial result in the first nine-months of 2024 indicated that its revenue rose 9.5 percent to €1.45 billion. But Telefonica’s total revenue fell 2.9 percent to €10.02 billion in Q3 and dipped 0.3 percent to €30.42 billion in nine-months of 2024. The difference between the revenue growth indicates the potential of B2B technology services.

Verizon

Verizon has improved Fujifilm’s global cybersecurity monitoring and intelligence capabilities, addressing the company’s prior lack of consistent cybersecurity measures across its subsidiaries.

The Security Information and Event Management (SIEM) platform collects logs, analyzes network activity for potential cyberattacks, and identifies suspicious behavior in real-time or near real-time, enabling rapid response.

With Verizon’s support, Fujifilm now benefits from efficient, around-the-clock centralized cybersecurity monitoring on a global scale.

GSMA Intelligence authors — Vivek Gautam, Silvia Presello, and Tim Hatt – in their report say that mobile operators must adopt an enterprise-centric, solution-oriented approach, behaving more like IT consultants than connectivity sellers. Are telecoms ready to grab share from IT service providers such as Tata Consultancy Services (TCS), Infosys, Accenture, Cognizant, etc?

Baburajan Kizhakedath