Telstra, one of Australia’s leading telecommunications companies, said its capital expenditure increased by $106 million in the first of half of fiscal 2024, primarily driven by higher payments for intangible assets associated with increased spending on software.

The company’s 5G population coverage reached approximately 87 percent, with 48 percent of mobile traffic now on 5G. Telstra has also surpassed its target of adding an additional 100,000 sq kms of mobile coverage, achieving over 140,000 sq kms since FY21.

The company’s 5G population coverage reached approximately 87 percent, with 48 percent of mobile traffic now on 5G. Telstra has also surpassed its target of adding an additional 100,000 sq kms of mobile coverage, achieving over 140,000 sq kms since FY21.

REVENUE

Telstra has unveiled its half-year financial results for the fiscal year 2024, reporting robust revenue and profit growth across various segments.

Telstra’s revenue reached $11.7 billion, marking a 1.2 percent increase compared to the same period last year. The company’s EBITDA stood at $4.0 billion, reflecting a notable 3.8 percent growth, while net profit surged to $1.0 billion, showing 11.5 percent increase.

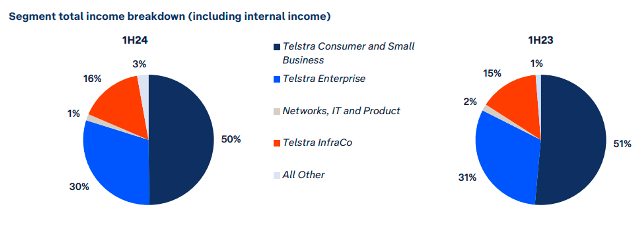

Telstra’s Consumer and Small Business segment experienced 1.1 percent rise in income, totaling $6,463 million. This growth was primarily driven by a 2.9 percent increase in mobile income, attributed to the uptick in Average Revenue Per User (ARPU) and Services In Operation (SIOs) across postpaid handheld and prepaid handheld devices.

However, Telstra’s revenue from mobile hardware saw a decline due to lower handset sales volumes, partially offset by increased sales of wearables and higher value handsets and accessories. Meanwhile, fixed product income dipped by 2.3 percent to $2,211 million, mainly due to declines in off-net revenue and Foxtel from Telstra revenue.

The Telstra Enterprise segment witnessed a 1.2 percent increase in income, reaching $3,899 million. While domestic mobile income grew by 3.2 percent, driven by Internet of Things (IoT) value-add applications, domestic fixed revenue experienced a 2.3 percent decline primarily due to decreases in Data Access Charges (DAC).

Additionally, Network Applications and Services (NAS) revenue recorded a slight increase, driven by growth in cloud applications, managed services, and equipment sales.

International income surged by 15 percent to $1,320 million, with significant contributions from internal revenue post-corporate restructuring, growth in international Wholesale and Enterprise revenue, and Digicel Pacific income.

Telstra InfraCo Income also saw an increase of 12.5 percent, reaching $2,045 million, attributed to growth in recurring nbn Definitive Agreement (DA) receipts.

Telstra’s CEO, Vicki Brady, in its earnings report, has expressed satisfaction with the overall momentum, highlighting the continued growth across mobile, Fixed Consumer and Small Business, and infrastructure segments. Vicki Brady emphasized the importance of the mobiles business in driving growth, citing a substantial increase in EBITDA driven by customer expansion, ARPU growth, and cost discipline.

In response to the performance of the NAS business, Telstra has initiated a detailed review of its domestic Enterprise segment, with plans to undertake significant actions aimed at addressing performance issues.

Furthermore, Telstra continues to invest in digital capabilities to enhance customer experience, increase productivity, and support digitalization efforts across industries. The company has achieved significant milestones in digitization, with 93 percent of Consumer & Small Business sales now on the new digital stack and 71 percent of key service transactions digitized.

Baburajan Kizhakedath