T-Mobile US has raised its forecast for monthly bill-paying wireless subscriber additions for a third time, as more Americans pick its superior 5G services and cheaper plans compared to rivals AT&T and Verizon.

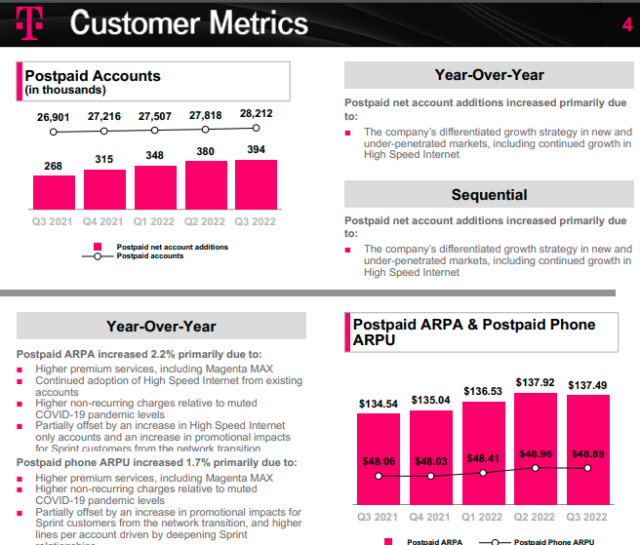

The company added 854,000 monthly bill-paying phone subscribers in the third quarter, and 578,000 high-speed internet customers.

In comparison, AT&T added 708,000 postpaid phone subscribers and Verizon, the largest U.S. carrier by subscribers, added only 8,000 customers in the same period.

T-Mobile expects to add between 6.2 million and 6.4 million net monthly-bill paying subscribers in 2022, up from a prior forecast of 6 million to 6.3 million.

T-Mobile also has an edge in the 5G game, owing to the chunky 2.5Ghz mid-band spectrum it won through its $23 billion buyout of rival Sprint in 2020, while Verizon and AT&T are building up the mid-band that provides a good balance of capacity and coverage.

So, while other telcos bear huge costs on 5G deployments, T-Mobile’s roll-out has been less expensive and helpful in managing costs, CFRA analyst Keith Snyder said.

T-Mobile, the leader in 5G, said its Extended Range 5G covers 97 percent of Americans, reaching more square miles than Verizon and AT&T combined. T-Mobile’s Ultra Capacity 5G covers 250 million people nationwide.

Nearly 55 percent of T-Mobile’s postpaid customers have a 5G smartphone. This indicates that nearly 15 million T-Mobile customers have a 5G smartphone. T-Mobile does not reveal the number of 5G customers on its network.

T-Mobile said its 2022 Capex is expected to be between $13.7 billion to $13.9 billion, an increase from prior guidance of $13.5 billion to $13.7 billion, reflecting T-Mobile’s accelerated build-out of its nationwide 5G network and purchases of high speed Internet routers, Neville R. Ray, T-Mobile US, President of Technology, said.

One-third of all business hubs will have a 5G connection by the end of 2022. IoT connections are expected to grow by 16 percent. “Private networks and managed services are supposed to be well over 44 percent CAGR year-over-year,” Callie R. Field, President of T-Mobile Business Group, said.