The GSMA’s latest ‘Global Spectrum Pricing Report’ highlights the increasing financial strain that spectrum costs impose on mobile network operators (MNOs), with significant implications for global digital growth and infrastructure investment.

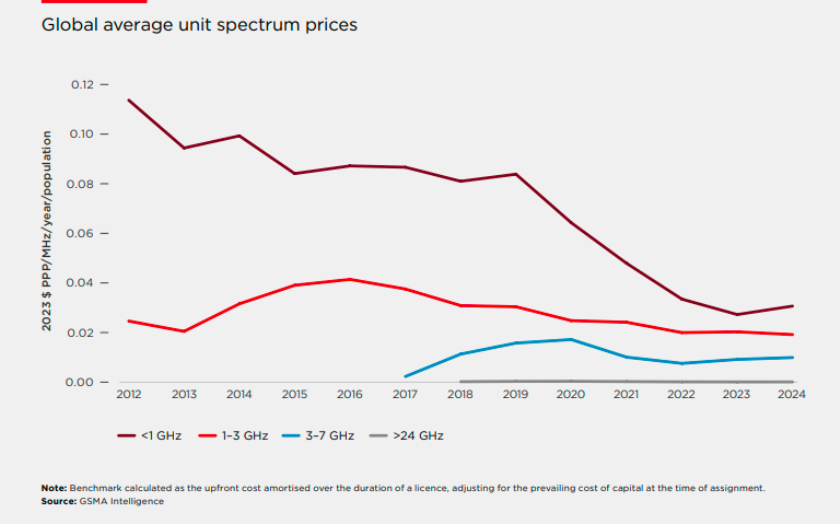

Despite a decline in both consumer mobile service prices and the average cost per megahertz (MHz) of spectrum, overall spectrum costs as a percentage of operator revenues have risen dramatically over the past decade. This trend has placed mounting pressure on MNOs, hindering their capacity to invest in essential network expansions and improvements, particularly for 4G and 5G networks.

Key Findings:

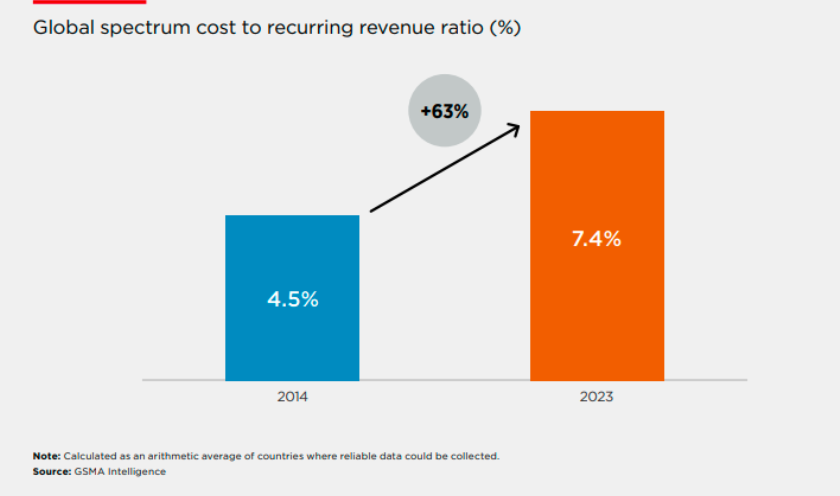

Rising Spectrum Costs: Spectrum costs now account for 7 percent of operator revenues globally, a 63 percent increase over the last ten years. Meanwhile, revenue per MHz has decreased by 60 percent.

Between 2014 and 2024, the average revenue generated per MHz of spectrum by operators dropped by 67 percent. In countries like Canada and Thailand, spectrum costs tripled due to new spectrum additions, while in places like Italy and Spain, costs stabilized as older, expensive licenses expired. Spectrum costs vary significantly by country — they can consume up to 25 percent of operator revenues in India and Pakistan but less than 2 percent in Japan and China.

Increased Spectrum Holdings: Despite cost reductions in specific spectrum bands (up to 75 percent in some cases since 2014), operators have increased their spectrum holdings by 80 percent to accommodate rising data demands, inadvertently elevating overall costs.

Declining Revenue per GB: The report highlights a 96 percent drop in revenue per gigabyte of data over the past decade, underscoring a critical revenue squeeze amidst escalating spectrum costs.

Policy Impact: The GSMA identifies public policy decisions — such as setting artificially high reserve prices and attaching onerous license obligations — as key drivers of inflated spectrum costs in certain markets. In some countries, spectrum costs represent as much as 25 percent of operator revenues.

Impact on Network Investment: Elevated spectrum costs correlate with reduced network coverage and slower mobile speeds, posing a risk to digital inclusion and economic development.

Impact on network investment and consumers: High spectrum prices negatively impact both network investment and consumers. A 10 percentage point (pp) increase in the spectrum cost-to-revenue ratio can reduce network coverage by up to 6 pp and decrease download and upload speeds by 8 percent and 6 percent, respectively. Conversely, increasing spectrum availability by 10 percent can improve coverage by up to 1.5 pp, download speeds by 4 percent, upload speeds by 2 percent, and reduce latency by 1 percent. Thus, making more spectrum available at affordable prices enhances mobile service quality and helps close the digital divide.

Recommendations:

Governments and regulators are urged to align spectrum prices with current market conditions to foster sustainable digital growth.

Policymakers are advised to reconsider pricing frameworks for the nearly 1,000 spectrum licenses set to expire by 2030, presenting a pivotal opportunity to reset pricing policies in line with economic realities.

Conclusion: The GSMA report emphasizes the need for a balanced approach to spectrum pricing that reflects market dynamics and supports long-term digital expansion. By prioritizing affordable spectrum costs, governments can facilitate greater investment in network infrastructure, enhance mobile service quality, and accelerate digital inclusion globally.

Baburajan Kizhakedath