The June 2025 Ericsson Mobility Report highlights how 5G is reshaping telecom industry priorities with accelerating adoption, innovative monetization models, and expanding use cases across consumer and enterprise segments.

5G Trends

A key trend is the rise of Fixed Wireless Access (FWA) powered by 5G, which serves as a mainstream broadband alternative. Over 80 percent of global communications service providers (CSPs) offer FWA, with 5G-enabled speed-based tariff plans gaining momentum. These plans replicate cable-like services and allow CSPs to better monetize their networks.

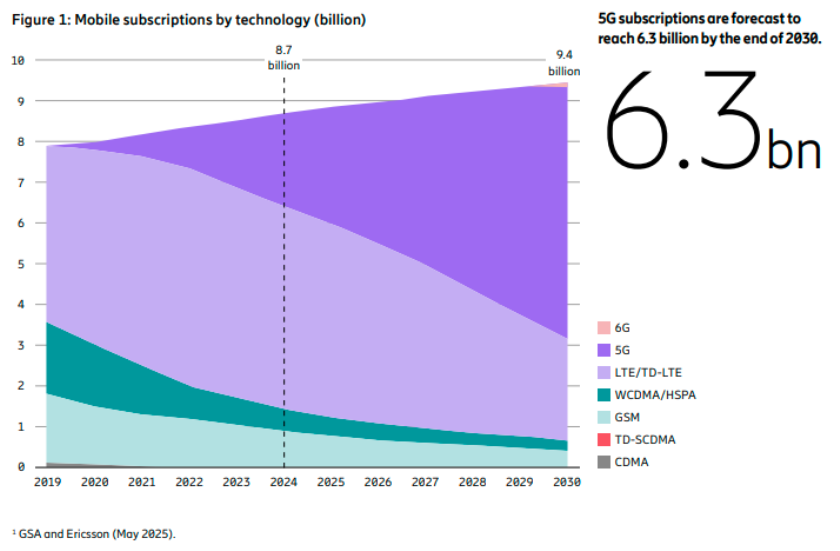

Globally, 5G subscriptions are expected to reach 2.9 billion by the end of 2025, accounting for roughly one-third of mobile subscriptions. Looking ahead, the number is forecast to grow to 6.3 billion by 2030. Meanwhile, 5G networks handled 35 percent of mobile data traffic in 2024, with projections indicating that figure will exceed 80 percent by 2030.

Investments

Network investments continue to focus on expanding 5G Standalone (SA) and mid-band deployments. North America leads in 5G mid-band population coverage at over 90 percent, followed closely by India at 95 percent, while Europe lags at just above 50 percent.

The report emphasizes the strategic importance of 5G SA and 5G Advanced in enabling differentiated services, such as network slicing and Quality on Demand (QoD), which create new monetization opportunities. Use cases span live broadcast production, gaming, VPNs, and venue connectivity. Operators like BT in the UK have already rolled out 5G SA networks to 40 percent of the population.

Consumer Focus

CSPs are shifting from simple data offerings to value-based services, with consumer packages now featuring speed tiers, entertainment bundles, and experience-focused solutions. These services are designed to meet rising expectations in areas like home connectivity, live streaming, and immersive content.

5G FWA is becoming increasingly popular in areas lacking traditional wired broadband, with projections suggesting it will account for more than 35 percent of all new fixed broadband connections by 2030.

At the same time, CSPs are responding to new demand drivers such as generative AI applications, which may influence mobile traffic in the future, depending on adoption levels and data intensity.

Outlook

Ericsson CTO Erik Ekudden describes this phase as an “inflection point,” as service providers move beyond infrastructure deployment to unlock transformative innovation and commercial potential through 5G. The report encourages continued investment in standalone architecture and mid-band spectrum to fully realize the growth opportunities of the 5G ecosystem.

TelecomLead.com News Desk