The mobile services sector in China is set to experience substantial growth, with the total revenue projected to surge at a Compound Annual Growth Rate (CAGR) of 4.1 percent from $146.4 billion in 2023 to $179.1 billion in 2028, according to forecasts by GlobalData.

The driving force behind this anticipated growth lies in the flourishing mobile data services segment, which is poised to counterbalance the decline in mobile voice service revenues in China over the forecast period.

The driving force behind this anticipated growth lies in the flourishing mobile data services segment, which is poised to counterbalance the decline in mobile voice service revenues in China over the forecast period.

Mobile voice service revenue in China is expected to decrease at a CAGR of 8.8 percent from 2023 to 2028.

Mobile data revenue in China is forecasted to witness an upward trajectory, growing at a CAGR of 7.4 percent during the same period. This surge can be attributed to the increasing adoption of higher Average Revenue Per User (ARPU) 5G services.

A key contributing factor to the growth in mobile data revenue in China is the projected increase in average monthly mobile data usage in China, forecasted to rise from 13.3 GB in 2023 to 22 GB in 2028. This surge is driven by the escalating consumption of online video and social media content via smartphones, thanks to the widespread availability of 5G services.

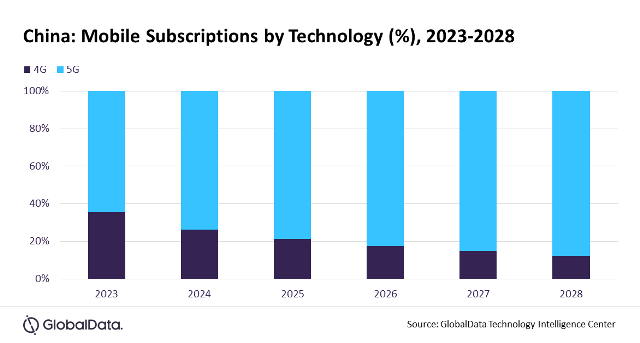

In 2028, 5G subscriptions in China are estimated to constitute a significant majority, holding an 87.5 percent share of the total mobile subscriptions. This surge is attributed to the relentless expansion of 5G networks by operators and the proliferation of 5G-enabled smartphones.

Leading the mobile services market in 2023 was China Mobile, and the company is expected to maintain its dominant position through 2028. This sustained leadership is supported by China Mobile’s ongoing 5G network expansions, specifically tailored to meet the escalating demand for high-speed services from both residential and enterprise segments.

Notably, China Mobile has invested a substantial amount, approximately CNY42.3 billion ($5.8 billion), in 5G infrastructure in the first half of 2023, out of a planned CNY83 billion ($11.68 billion) for the entire year.