BofA Securities has recently released a report indicating the top priorities for Indian telecom operators such as Bharti Airtel, Vodafone Idea and Reliance Jio in the 5G business.

Most telcos have rolled out NSA 5G given lack of good 5G applications with a select few focused on SA 5G. India will be different here as Jio’s aggressive rollout will force Bharti to respond back with similar aggressive rollout.

“Unlike 4G where watching video turned out to be a killer-app enticing users to move to 4G, we are not seeing anything similar in 5G yet to entice users to move to 5G,” BofA Securities said.

In developed markets, operators promoted 5G as a premium service with better speeds, leading to high-end users migrating to 5G. In an emerging market like India, there are no good killer apps for uptake of 5G. Better video resolution will unlikely be a killer app in India.

Global case-studies show that whenever a Capex cycle picks up, telco stocks have underperformed the benchmark index. This is because the investment was mainly front loaded with benefits being seen more back-end loaded.

Globally most of the 5G use cases are FWA (fixed wireless access) connectivity, AR/VR (augmented reality/virtual reality) immersive experiences, gaming etc. But none of them are at meaningful scale. Mass-scale unique apps are key for 5G to pick-up.

If India doesn’t see good use-cases appealing to a mass audience, then Jio’s first mover advantage in 5G could be neutralized. Airtel could either buy 700 MHz or refarm its 900 MHz overtime to use it for 5G.

A differentiated 4G network rollout helped Jio to overtake other telcos and be the number 1 telco in India. Despite this, Jio lacks a lot of high-end users who are currently with Airtel and Vi. Jio is looking to replicate the same playbook with a differentiated 5G network with focus being on the high-end postpaid base.

Jio will likely have a first mover advantage with better in-building coverage due to 700 MHz and better offerings like slicing due to SA network.

Jio may not be able to attract many postpaid subs to Jio. This is because the high end base is lethargic and such enterprise contracts are on back of relationships.

According to Global Mobile Suppliers Association (GSA), 499 telecom operators globally are investing in launching 5G services. Globally, NSA 5G rollout is the most preferred route for 5G launch, initially. 111 operators (c.22 percent of all telcos investing in 5G) in 52 countries/ territories worldwide have been investing in public 5G SA networks in form of trials, planned or actual deployments.

Out of these:

At least 29 operators in 18 geographies have launched public 5G SA networks

6 telcos have deployed 5G SA technology but not yet launched services or have only soft-launched them

At least 21 operators are deploying or piloting 5G SA for public networks

32 operators are planning to deploy the technology, and 20 operators are being involved in evaluations, tests or trials of 5G SA.

Telcos in Korea and China were more aggressive in SA 5G rollout as the vendors in their countries i.e. Samsung and Huawei were focusing on selling 5G equipment. The telcos in most other counties focused on rolling out NSA 5G given no clear applications which had mass scale demand/

5G rollout will be more aggressive in the Indian market, based on the comments from telcos.

Jio will use its differentiated 5G network to poach high-end subs. Jio doesn’t have many high-end postpaid users. This would force Airtel to respond, leading to capex being front-loaded.

Below are the likely investments needed in core network.

Tower additions: Airtel and Jio will rollout 5G with 20-25K 5G sites by end of CY22. Beyond that, the rollout pace will be determined by the supply of equipment. Jio is aiming rollout of c.50-60k 5G sites per year going ahead.

Fiberization: We estimate c.55 percent of Jio’s towers are connected by fiber versus c. 35 percent for Bharti Airtel. Both telcos overtime will continue to fiberize towers. They could also look at alternatives like E-band as a substitute to reduce costs. Drawback though is distance travelled on E-band is c.50 meters without boosters.

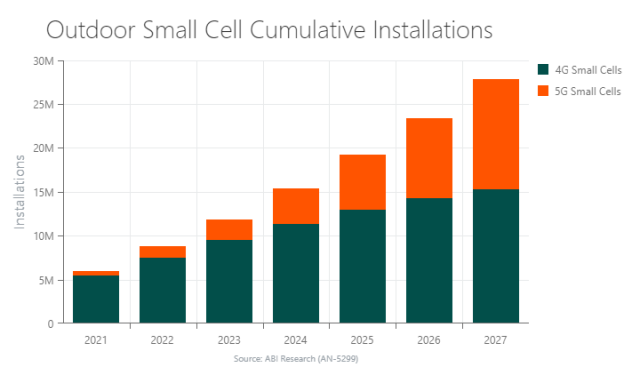

Small-cells: Currently Jio has c.70K small-cells and Bharti Airtel has c.15-20K small-cells. But most of these small-cells use 20W radio (not low power 5W). As a result, these small-cells are in-effect similar to that of towers who use same power. Hence, such equipment is ultra-lean sites or extended towers versus small-cells in its true sense. Eventually these small-cells will be upgraded. The potential of small-cells could be unleashed in next 12-24 months and we estimate India to have 250K small-cells in next 2-3 years from current 100K.