TelecomLead.com Research team has analyzed the network investment strategy and revenue growth of Telkomsel, Indosat Ooredoo Hutchison and XL Axiata in Indonesia in 2023.

Telkomsel data customersGlobalData report

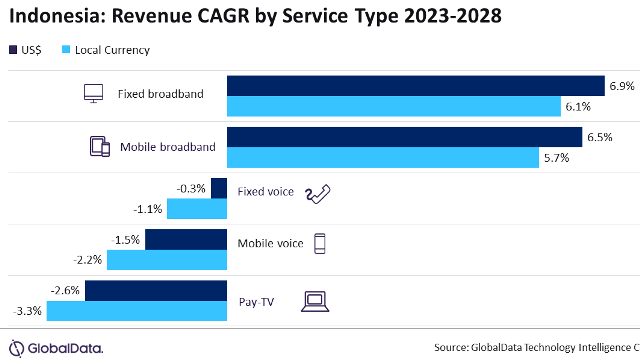

Indonesia’s telecom and pay-TV services revenue is projected to grow at a 4.5 percent CAGR from $15.1 billion in 2023 to $18.8 billion in 2028, driven by increased adoption of 4G/5G services and fiber broadband, GlobalData report said.

Growth in 4G and 5G subscriptions will drive mobile data revenue, with 5G expected to account for 20.8 percent of total mobile subscriptions by 2028.

Ministry of Communications and Informatics’ push to phase out 3G has led to major 4G network expansion by providers like Telkomsel, now covering 97 percent of Indonesia’s population.

Fixed broadband revenue is set to grow at a 6.9 percent CAGR, driven by the expansion of fiber networks. Infrastructure companies like Fiberstar aim to increase fiber reach to 2.8 million homes by end-2024.

Revenue from pay-TV services will decrease due to declining cable TV subscriptions and falling ARPU in the sector.

Telkomsel

Telkomsel is following the theme “Reach Beyond, Advancing the Nation”. Indra Mardiatna, Telkomsel Director of Network, is responsible for network investment.

The number of BTS has decreased to 247,472 in 2023 from 265,194 in 2022 and 251,116 in 2021. Out of 247,472 BTS in 2023, the number of 3G/4G/5G BTS has reached 198,492 in 2023 as against 215,036 in 2022 and 200,875 in 2021.

Telkomsel reported revenue of Rp 102.4 trillion in 2023, up from Rp 89 trillion in 2022 and 87.5 trillion rupiah in 2021, showing consistent growth over recent years.

The company’s digital business revenue reached Rp 78.5 trillion, with data services contributing Rp 65.9 trillion and digital services accounting for Rp 12.5 trillion, reflecting the strong demand for data.

Telkomsel maintained 247,472 Base Transceiver Stations (BTS), down from previous years, with 4G and 5G BTS making up a significant portion (197,838 4G BTS and 654 5G BTS). Telkomsel expanded 4G coverage to reach 97 percent of Indonesia’s population and launched 5G services in over 49 cities.

Telkomsel served 159.3 million total customers in 2023, up from 156.8 million in 2022 and 176 million in 2021, with data users growing to 127.1 million from 120.9 million in 2022 and 120.5 million in 2021.

The company handled 17.9 million terabytes of data traffic in 2023, reflecting increased customer demand for digital services.

Indosat Ooredoo Hutchison

Indosat Ooredoo has reported a total revenue of Rp 51.2 trillion for 2023, marking a 10 percent increase year-on-year, driven by growth in consumer and enterprise segments across cellular, multimedia, data, and internet services.

Cellular revenue rose by 8.7 percent due to increased data and interconnection revenue, while data traffic rose by 14.8 percent to 14,417 PB.

The company’s 4G BTS sites increased by 30.7 percent to 179,000, improving coverage and service quality.

Indosat reported a 5.3 percent increase in average revenue per user (ARPU) and improved customer satisfaction scores (CSAT), with IM3 at 84.1 and Tri at 84, highlighting successful customer engagement.

Indosat advanced its transformation from a telecom to a tech company, expanding network coverage and launching the Indosat Marvelous Xperience (MX) Center for innovation. The myIM3 and bima+ apps saw a 8.6 million increase in monthly active users to reach 37.7 million, underscoring the digital business’s potential.

Indosat increased its Home Broadband customer base to 336,900 through acquisitions, including MNC Play’s customer assets, strengthening its position in the fixed broadband market.

XL Axiata

XL Axiata’s revenue grew by 11 percent in 2023, reaching Rp 32.34 trillion, driven by network expansion and enhanced customer reach. Vivek Sood is the chief executive officer of XL Axiata.

XL Axiata has increased its BTS count to 160,124, with 104,993 being 4G BTS — up 10 percent. XL Axiata continued focusing on regions outside Java, with 4G BTS in Kalimantan growing by 12 percent, and traffic increasing by 21 percent.

XL Axiata achieved 61 percent fiberization across sites and deployed technologies like Cisco Ultra Traffic Optimization and Dynamic Spectrum Sharing 4G/5G to optimize network capacity.

The green BTS initiative, launched in 2014, now covers 90 percent of XL Axiata’s BTS sites, underscoring its commitment to sustainable operations.

With a capital expenditure of Rp 7.16 trillion, XL Axiata continued its network expansion across Indonesia, further strengthening connectivity, especially in underserved regions. The company has now deployed 159,000 kilometers of fiber optic network.

Baburajan Kizhakedath