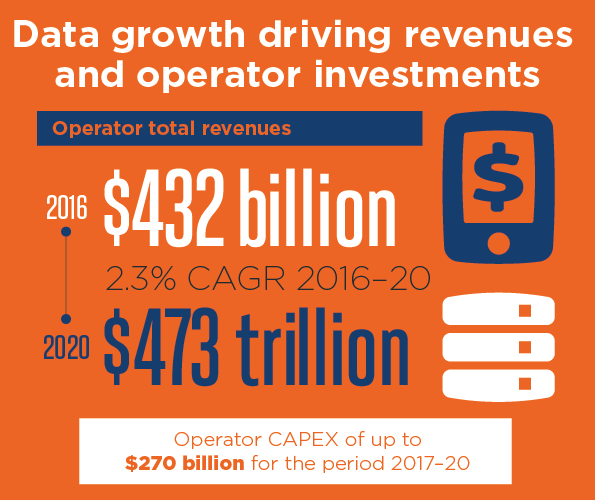

GSMA says Asian telecom operators will be making an investment of $270 billion during 2017-2020.

China and India will account for almost half of all the new mobile subscriber additions by the end of 2020.

India will account for 27 percent (206 million) and China 21 percent (155 million) of the 753 million new mobile subscriber additions by the end of 2020.

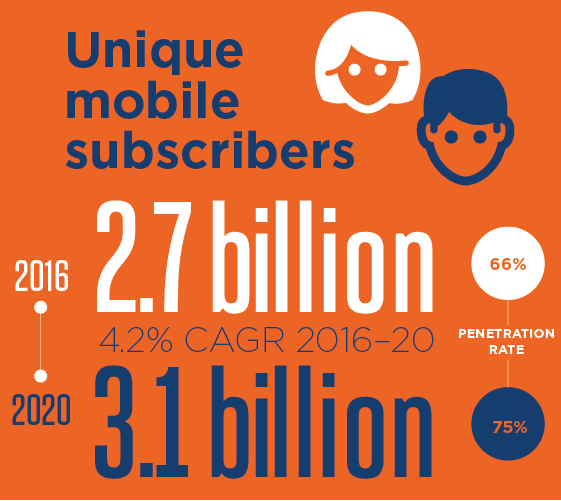

The Asia Pacific region is forecast to increase from 2.7 billion unique mobile subscribers in 2016 to 3.1 billion in 2020, accounting for two-thirds of global growth.

“Led by India and China, Asia’s mobile industry will be the main engine of global subscriber growth for the remainder of the decade, connecting almost half a billion new customers across the region by 2020,” said Mats Granryd, director general of the GSMA.

Advanced operators in Asia are set to become among the first in the world to launch commercial 5G networks before the end of the decade.

Mobile penetration in Asia Pacific will grow from 66 percent in 2016 to 75 percent in 2020. Top five most penetrated mobile markets in the world are Hong Kong, Japan, Singapore and Taiwan. One of the least penetrated markets is North Korea.

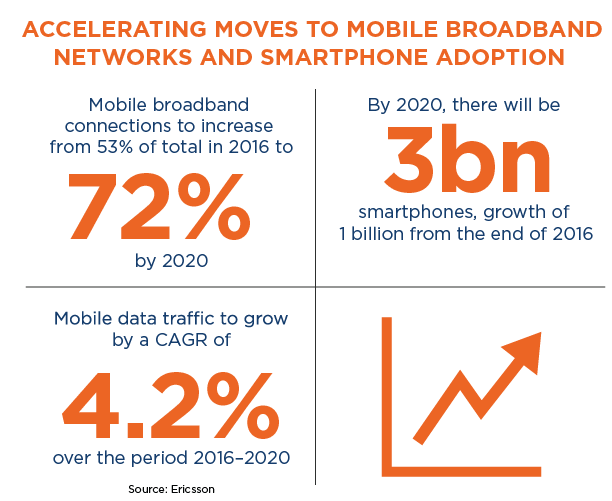

Mobile broadband (3G and above) is the dominant technology in the region, accounting for more than half of connections for the first time last year.

Mobile broadband (3G and above) is the dominant technology in the region, accounting for more than half of connections for the first time last year.

Asian markets such as China, Japan and South Korea are driving the development of 5G mobile technologies. 5G connections (excluding IoT) are anticipated to reach 670 million in Asia Pacific by 2025, accounting for just under 60 percent of global 5G connections.

Asia’s mobile ecosystem supported approximately 16 million jobs in 2016, directly and indirectly. Ecosystem made a tax contribution to the public finances of the region’s governments of around $166 billion last year.

Mobile internet penetration in Asia Pacific doubled over the last five years, reaching approximately half of the regional population in 2016.