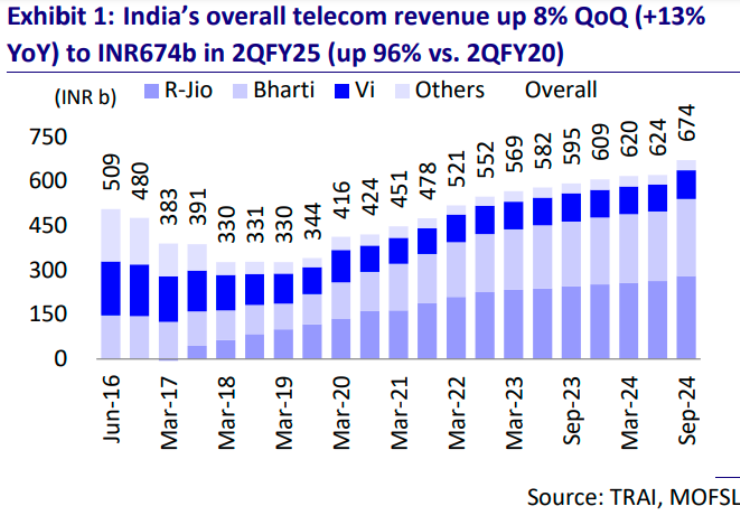

The latest TRAI report has details on the size of Indian telecom service revenue in September-quarter of 2024.

India’s telecom industry saw an 8 percent QoQ growth in revenue (AGR including NLD) to INR674b (+13 percent YoY) in 2QFY25, driven by the impact of tariff hikes.

The ARPU increased 9 percent QoQ to INR194/month.

Subscriber base declined by approximately 17 million (~1.5 percent).

Telecom spending as a percentage of nominal GDP rose to ~0.9 percent in 2Q (up from 0.8 percent in 1Q).

Bharti Airtel has emerged as the main beneficiary of tariff hikes, securing ~49 percent of the incremental RMS in 2QFY25, outperforming its overall RMS of ~39 percent.

Industry revenue growth is expected to stay strong as the full benefits of tariff increases materialize over the coming quarters. Motilal Oswal Research Analysts Aditya Bansal, Tanmay Gupta and Siddhesh Chaudhari said.

Bharti Airtel has recorded a robust performance in 2QFY25 with AGR rising ~11 percent QoQ to INR260b (+19 percent YoY), supported by an implied ARPU increase of 11 percent to INR224.

Bharti Airtel’s incremental RMS for the quarter stood at ~49 percent, ahead of its competitors. RJio’s AGR grew ~7 percent QoQ to INR280b (+14 percent YoY), with ARPU improving ~7 percent to INR199.

Vi, however, lagged behind as subscriber losses offset a 7 percent ARPU growth, resulting in a modest 5 percent QoQ revenue increase to INR97b.

Meanwhile, BSNL saw an 8 percent revenue growth, driven by subscriber share gains and a 6 percent ARPU uptick.

Regional trends revealed that Circles A and B drove industry growth with a 9-10 percent ARPU increase, while Metros and C Circles experienced lower growth at ~7 percent. Revenue growth mirrored this trend, with Circles A and B achieving ~10 percent/8 percent growth, while Metros and C Circles saw ~7 percent growth. Bharti Airtel led revenue gains across A, B, and C circles, while Vi achieved ~14 percent growth in Metros.

Since Sep’19, the Indian telecom industry’s ARPU has nearly doubled from INR98 to INR193, driven by three rounds of tariff hikes. While revenue has surged by 96 percent over five years (~14 percent CAGR), the subscriber base has slightly declined from 1.17t to 1.15t, with the decline more pronounced when adjusting for M2M/IoT SIM growth.

Bharti Airtel and Reliance Jio accounted for ~97 percent of incremental revenue during this period, with Bharti Airtel’s revenue growing ~2.6x (~21 percent CAGR) and Jio’s by ~2.4x (~19 percent CAGR).

In contrast, Vi’s revenue growth was modest, contributing only ~2 percent to incremental RMS since Sep’19, as subscriber losses offset the gains from tariff hikes.

Baburajan Kizhakedath