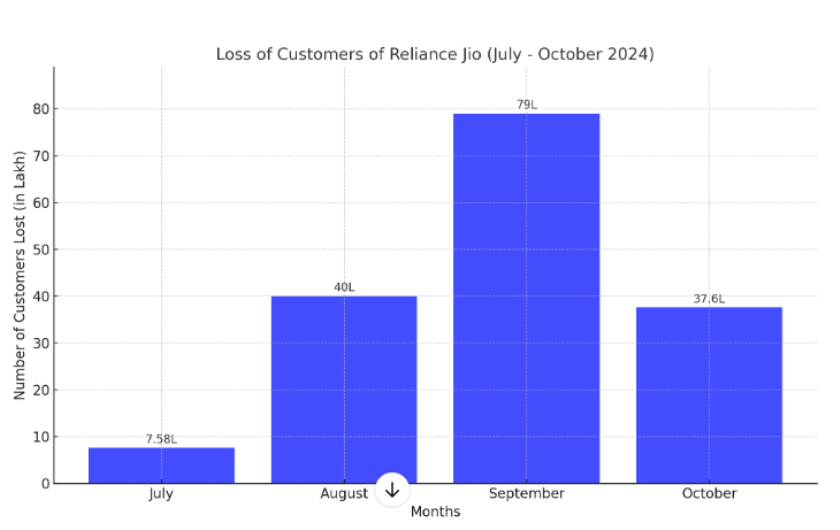

The latest TRAI data has indicated that Reliance Jio, India’s largest telecom operator, lost nearly 1.65 crore subscribers over four months, including 37.6 lakh in October, 79 lakh in September, 40 lakh in August, and 7.58 lakh in July 2024.

Airtel has gained 24 lakh mobile subscribers in October but had lost 14.3 lakh in September, 24 lakh in August, and 16 lakh in July. Vodafone Idea lost 19 lakh subscribers in October, following a decline of 15.5 lakh in September.

The decline in subscriber numbers for private telecom operators is attributed to a tariff hike implemented in mid-2024. In contrast, BSNL continued to gain subscribers, adding 5 lakh in October and a total of 68 lakh over the last four months.

As of October, Reliance Jio had 47.48 crore subscribers, Bharti Airtel had 28.7 crore, Vodafone Idea had 12.5 crore, and BSNL had 3.6 crore.

Reliance Jio held the largest market share at 39.99 percent, followed by Bharti Airtel with 33.50 percent, Vodafone Idea with 18.30 percent, and BSNL with 8.05 percent.

Total wireless subscribers stood at 1,150.42 million at the end of October, marking a marginal monthly decline of 0.29 percent.

Top broadband (wired and wireless) service providers are Jio (474.81 million), Airtel (287.67 million), Vodafone Idea (4.22 million), BSNL (36.38 million), and Atria Convergence Technologies (2.27 million) at the end of October.

Top wired broadband service providers are Jio (14.79 million), Airtel (8.91 million), Vodafone Idea (125.43 million), BSNL (36.38 million), Atria Convergence Technologies (2.27 million) and Kerala Vision Broadband (1.24 million) at the end of October.

Top wireless broadband service providers are Jio (460.02 million), Airtel (278.76 million), Vodafone Idea (125.43 million), BSNL (32.15 million) and Intech Online (0.25 million) at the end of October.

Wireline subscribers increased from 36.93 million in September to 37.79 million in October. Leading fixedline service providers in India are Reliance Jio (41.51 percent), Bharti Airtel (25.25 percent), BSNL (16.14 percent), Tata Teleservices (6.28 percent), MTNL (5.46 percent), Vodafone Idea (2.24 percent)

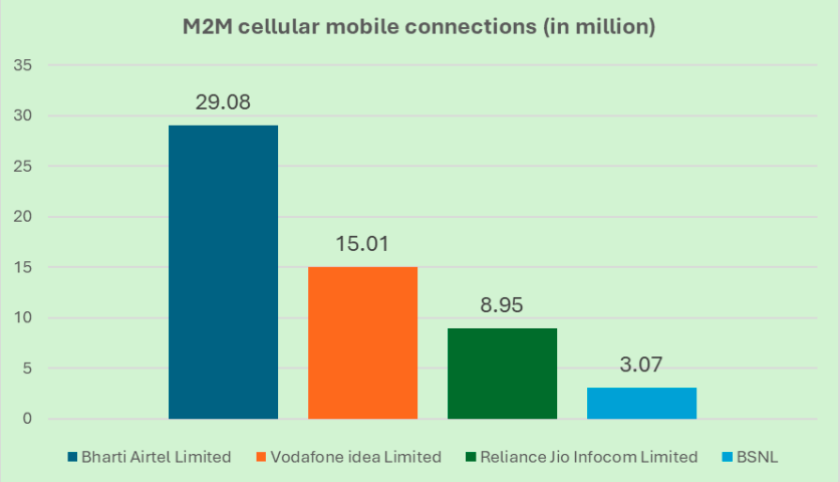

The number of M2M cellular mobile connections increased from 54.64 million in September to 56.12 million in October.

Top M2M operators are Airtel (29.08 million), Vodafone Idea (15.01 million), Reliance Jio (8.95 million) and BSNL (3.07 million).

Baburajan Kizhakedath