The latest GlobalData report has revealed what’s size of telecom and pay-TV services revenue in South Korea.

The telecom and pay-TV services revenue in South Korea is projected to grow at a CAGR of 1.9 percent from $32.3 billion in 2024 to $35.4 billion in 2029, driven by strong growth in the mobile broadband segment.

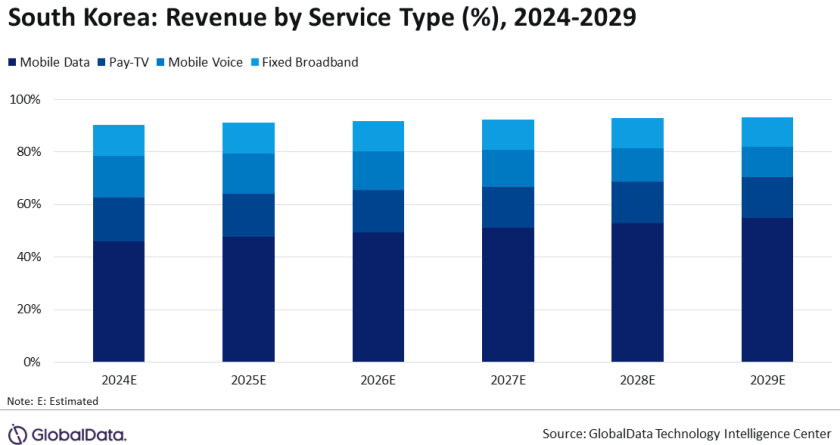

Mobile data service revenue in South Korea will increase at a CAGR of 5.6 percent, fueled by the rising adoption of 5G subscriptions, which offer higher ARPU.

Mobile voice service revenue in South Korea will decline due to falling ARPU as operators bundle free voice minutes into plans and users shift to OTT platforms.

5G services will dominate mobile subscriptions in 2024 in South Korea, with their share rapidly increasing to 89.2 percent by 2029. This growth is supported by the government’s 5G+ strategy, which aims for over 90 percent mobile user access to 5G by 2026 through investments, regulatory reforms, and infrastructure development.

In fixed communications, voice service revenue in South Korea will decline due to decreasing ARPU and subscription losses in VoIP and circuit-switched segments. Fixed broadband service revenue will grow at a CAGR of 1.2 percent, driven by increasing FTTH/B adoption and government and operator efforts to expand fiber-optic infrastructure.

Pay-TV service revenue in South Korea will see marginal growth at a CAGR of 0.4 percent, with rising IPTV subscriptions offsetting declines in cable TV and DTH subscriptions.

SK Telecom will lead the mobile services market throughout the forecast period, supported by competitive pricing, unlimited data options, and enterprise-focused M2M/IoT services.

KT will maintain leadership in fixed voice, fixed broadband, and pay-TV segments, driven by its strong FTTH and xDSL offerings and discounted multiplay packages that combine broadband and pay-TV services in South Korea.

Baburajan Kizhakedath