Latin American (LATAM) smartphone market grew by 11.2% year-on-year (YoY) in Q3 2024, according to Counterpoint Research’s Market Monitor report.

This marks the fifth consecutive quarter of YoY growth and the third straight quarter of double-digit expansion.

The region’s growth has been bolstered by increased competition, particularly among Chinese brands, and strategic inventory stockpiling ahead of the holiday season, the report said

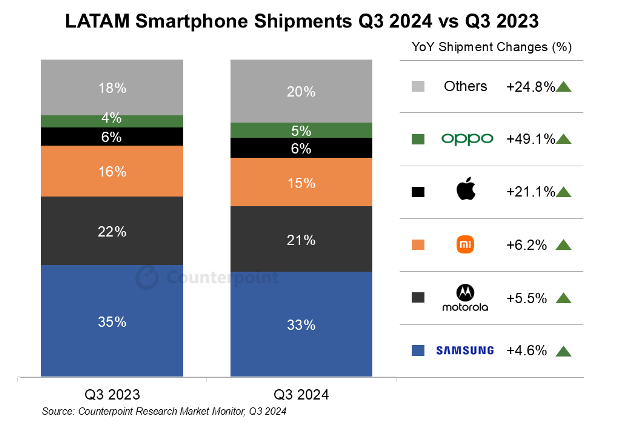

Samsung led the LATAM market with a 33.2% share, recording a 5% YoY growth in shipments. The company’s aggressive inventory stocking and partnerships with installment payments and discounts helped it maintain its leadership position across most countries.

Apple posted a 21% YoY increase in shipments, driven by strong demand in Brazil and Mexico. The brand’s strategy of locally assembling legacy models at reduced prices, such as the iPhone 13, proved successful. The recently launched iPhone 16 contributed to Apple’s growth, particularly in Mexico, which was part of the global launch schedule.

OPPO registered the highest YoY growth among the top five brands at 49.1%, strengthening its position in Mexico and improving its foothold in Colombia through marketing initiatives. However, its expansion across the broader LATAM region remains challenging due to competition from other Chinese brands.

Xiaomi saw a 6% YoY growth, aided by local assembly initiatives in Argentina and government crackdowns on Brazil’s grey market. Motorola also grew by over 5% YoY, leveraging competitively priced models like the Moto G34, one of the region’s most affordable 5G smartphones.

Regional dynamics

While most LATAM countries reported YoY growth, Argentina, Colombia, and Ecuador lagged due to ongoing economic challenges. However, Argentina experienced the highest quarter-on-quarter (QoQ) growth, with shipments more than doubling from Q2 2024.

Despite growing 4G smartphone volumes, 5G adoption remains limited in LATAM as consumers prioritize features like better cameras, larger screens, and higher memory at affordable prices. Chinese brands have successfully met these demands with competitively priced 4G models.

Emerging players and market trends

HONOR recorded double-digit YoY growth and gained traction in Central America and the Caribbean, establishing itself among the top five brands in most LATAM countries.

As the holiday season approaches, the LATAM smartphone market is expected to maintain its upward trajectory, supported by competitive pricing, inventory buildup, and local manufacturing initiatives by leading brands.