The smartphone market in the Philippines is experiencing growth and competitive shifts that mirror broader Southeast Asian trends, Canalys said.

With Southeast Asia’s market growing by 15 percent year-on-year in Q3 2024 to 25.0 million units, the Philippines contributed to this upsurge with high demand in both the budget and mid-range segments.

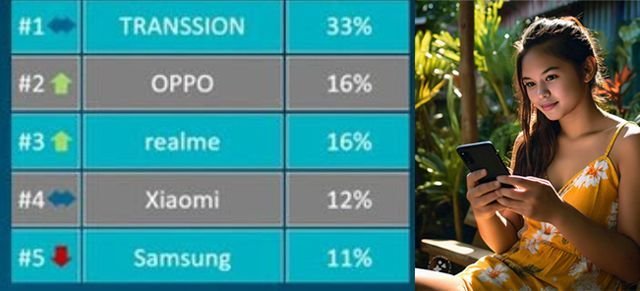

Top selling smartphone brands in the Philippines are Transsion, Oppo, Realme, Xiaomi and Samsung during the third-quarter of 2024.

Transsion has 33 percent share in the smartphone market in the Philippines in Q3 2024 as compared with 38 percent in Q4 2023.

Vivo was the second largest smartphone maker the Philippines with 13 percent in Q4 2023.

Oppo, which is the second largest smartphone brand the Philippines, has 16 percent share in Q3 2024 as compared with 13 percent in Q4 2023.

Realme has 16 percent share in the smartphone market in the Philippines in Q3 2024 as compared with 12 percent in Q4 2023.

Xiaomi has 12 percent share in the smartphone market in the Philippines in Q3 2024 vs 10 percent in Q4 2023.

Samsung has 11 percent share in the smartphone market in the Philippines in Q3 2024 as compared with 11 percent in Q4 2023.

The region-wide price decline of 4 percent in average selling prices (ASP) reflects the Philippines’ trend toward affordability.

Looking ahead, 5G is anticipated to be a significant growth factor in the Philippines. With 5G emerging, mid-range models that offer 5G capabilities will play a pivotal role in appealing to Filipino consumers. OPPO’s strong presence with affordable 4G models could transition well into 5G as network support improves. Samsung’s leadership in 5G positions it to capture this market as infrastructure and affordability improve in the Philippines.

The Philippines also presents a promising opportunity for premium brands. Apple, for example, has seen success in the broader Southeast Asian market due to its strategic expansion of distribution and branded stores, a model that could similarly appeal to the Philippine market’s growing middle-class consumers seeking premium devices.