The India smartphone market fell 4 percent year on year to just under 27 million units in Q2 2017, said Canalys.

The India smartphone market fell 4 percent year on year to just under 27 million units in Q2 2017, said Canalys.

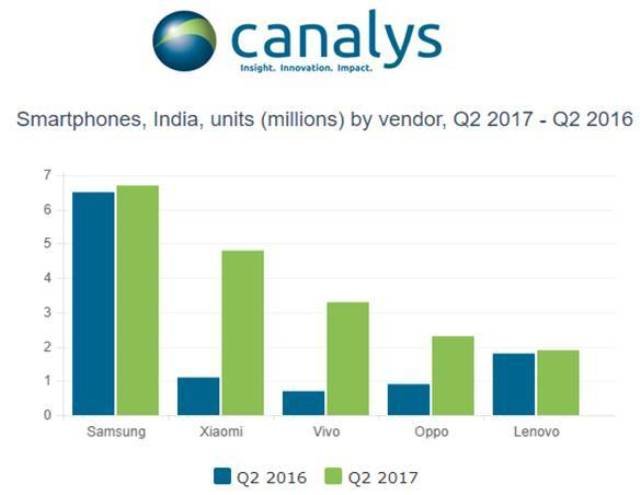

Samsung leads the Indian smartphone market with 25 percent share.

Xiaomi, which more than quadrupled its smartphone shipments to 4.8 million units this quarter, is the second largest smartphone brand in India.

Vivo took third place, shipping an all-time high of 3.4 million units, owing to its rising popularity among tier-two and tier-three cities.

Oppo has displaced Lenovo to take fourth place.

Lenovo finished fifth with 1.9 million smartphones.

Collectively, Xiaomi, Oppo, Vivo, Gionee and Lenovo control over 50 percent of India’s smartphone market.

“With China suffering its own decline this quarter, India is a market of huge strategic importance to Chinese smartphone vendors,” said Canalys Research Analyst Ishan Dutt.

Samsung is under immense pressure in the mid-tier from the Chinese players. Samsung’s low-end J Series is helping it sustain its lead and maintain share. The S8 and S8+ have helped it win back some of its premium share.

The Goods and Services Tax (GST), applicable in India from 1 July 2017, has adversely affected the market this quarter.

There is general confusion in the entire market over GST and a lack of awareness about the changes that are needed. “Apprehension among distributors and retailers regarding the impact on prices has caused the market to adopt a wait-and-see policy,” said Canalys Analyst Rushabh Doshi.

The India smartphone market will emerge stronger post-GST. Phone vendors can look forward to leaner distribution, faster delivery and increased demand from local retailers and distributors.

Earlier, market research agency GfK said smartphone demand in India grew 14 percent. GfK expects the recently announced Goods and Services Tax (GST) will have no impact on smartphone demand in the country.

GfK forecasts overall smartphone demand in the developing Asian region will total 234 million (+11 percent) units in 2017, representing the strongest growth across all regions in 2017.