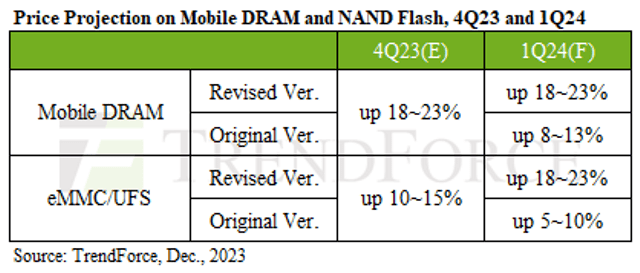

The first quarter of 2024 is poised to witness a substantial surge in prices for mobile DRAM and NAND Flash (eMMC/UFS), TrendForce said.

Projections indicate there will be an anticipated seasonal increase ranging between 18 percent and 23 percent in the prices for mobile DRAM and NAND Flash. This predicted escalation could potentially intensify within a market predominantly controlled by a select few major players, especially if brand clients resort to panic buying amid mounting pressure.

Projections indicate there will be an anticipated seasonal increase ranging between 18 percent and 23 percent in the prices for mobile DRAM and NAND Flash. This predicted escalation could potentially intensify within a market predominantly controlled by a select few major players, especially if brand clients resort to panic buying amid mounting pressure.

Insights gleaned for 1Q24 highlight consistent production planning strategies adopted by Chinese smartphone Original Equipment Manufacturers (OEMs). The notable surge in memory prices is driving buyers to proactively heighten their procurement endeavors, seeking to establish resilient and competitively stocked inventory levels.

TrendForce emphasizes the smartphone market’s historical role as an early barometer of economic downturns, with stakeholders in the supply chain continuously adapting their inventory management practices. As inventory levels dwindle and the repercussions of reduced manufacturing persist, a robust upswing in smartphone memory prices appears imminent.

The advent of 2024 is poised to witness a disproportionate rise in memory prices compared to other sectors. This upward trajectory, fueled by sustained client demand and the gradual scaling up of operational capacities by manufacturers, is anticipated to widen the gap between supply and demand. Memory prices are projected to be the primary driver behind this upward trend during the season.