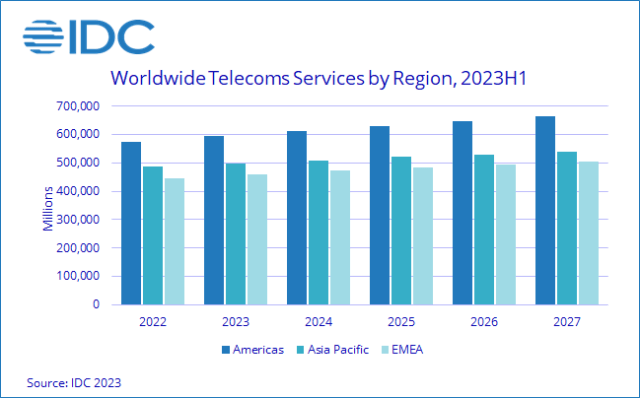

Worldwide spending on telecommunication and pay TV services is projected to reach $1.55 trillion in 2023, the International Data Corporation (IDC) said in its Worldwide Semiannual Telecom Services Tracker.

This represents a notable increase of 3.0 percent in telecommunication and pay TV services compared to the previous year, marking the third upward revision in the forecast in the last 12 months, with inflation being the primary driver behind this growth.

This represents a notable increase of 3.0 percent in telecommunication and pay TV services compared to the previous year, marking the third upward revision in the forecast in the last 12 months, with inflation being the primary driver behind this growth.

The revised forecast reveals some significant regional variations in spending trends. Notably, the Middle East and Africa (MEA) and Latin America have experienced above-average forecast revisions due to hyperinflation in countries like Turkey, Uganda, Egypt, and Argentina. In these regions, it has become commonplace to witness quarterly Average Revenue Per User (ARPU) growing by more than 50 percent on an annual basis.

Conversely, the forecast for the telecom services market in Western Europe has been slightly lowered due to economic challenges in key countries, such as Germany. IDC suggests that this could signify the emergence of a new market force that will exert downward pressure on growth rates as the forecast period progresses.

The impact of inflation on telecom markets varies considerably across countries. Some regulators permitted telecom operators to increase tariffs, leading to healthy service revenue growth in many nations. In contrast, these tariff increases prompted customers in certain countries to migrate to more affordable packages and operators, resulting in lower value growth rates. In countries like Italy, competitive conditions prevented operators from making tariff adjustments. Meanwhile, developing countries in Eastern Europe and Africa faced constraints on tariff increases due to their populations’ limited purchasing power.

An analysis of telecom services by type confirms that established trends continue to shape the industry. The mobile segment remains the largest, driven by the proliferation of mobile data usage and machine-to-machine (M2M) applications, offsetting declines in spending on mobile voice and messaging services.

Fixed data services will see growth as the demand for higher bandwidth services rises. Spending on fixed voice services is expected to decline as declining TDM voice revenues are not fully compensated by the increase in IP voice services.

Traditional Pay TV markets will experience a slight decline due to the growing popularity of video on demand (VoD) and over-the-top (OTT) services, even though these services will remain integral to the multi-play offerings of telecom providers worldwide.

As the prices of goods and services continue to rise, economic growth has started to decelerate following central bank interest rate increases. Consumers and businesses are grappling with the challenge of balancing increasing costs with limited budgets. Although the telecom services market exhibits relatively low elasticity, excess tariff hikes could impact demand.

Operators need to evaluate markets for tolerance to price increases. They should continuously assess and compare the product mixes, quality of services, pricing, and customer support capabilities of all supply-side participants. That information should help them find a magic percentage that will not scare the customers away, have a positive impact on revenues, and help them maintain healthy margins in these turbulent times, Kresimir Alic, research director, Worldwide Telecom Services at IDC, said.