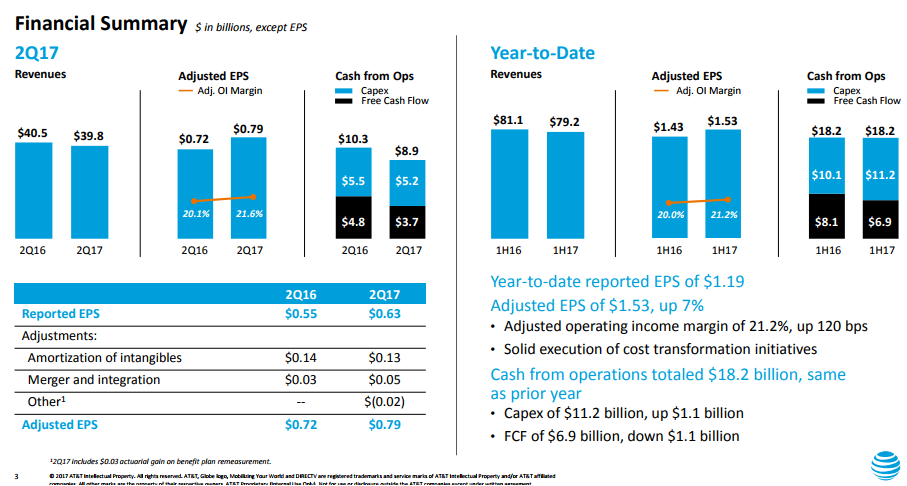

AT&T has posted revenue of $39.8 billion (–1.7 percent), operating expenses of $32.5 billion ($34 billion), operating income of $7.3 billion ($6.6 billion) with margin of 18.4 percent (16.2 percent) and net income of $3.9 billion ($3.4 billion) in the second quarter of 2017.

AT&T has posted revenue of $39.8 billion (–1.7 percent), operating expenses of $32.5 billion ($34 billion), operating income of $7.3 billion ($6.6 billion) with margin of 18.4 percent (16.2 percent) and net income of $3.9 billion ($3.4 billion) in the second quarter of 2017.

The decline in revenue of AT&T was due to dip in sale from wireline and mobile service business.

AT&T network

AT&T, announcing the earnings report, said its Capex (capital expenditure) has gone up by $1.1 billion to $11.2 billion during the second quarter.

AT&T’s network covers more than 99 percent of Americans with nearly 70,000 existing cell sites. AT&T is utilizing ~100 MHz of spectrum in top 100 metros. AT&T plans to deploy 60 MHz spectrum for further coverage.

AT&T has kicked off 5G Evolution network in Austin and Indianapolis, reaching 20+ markets by year-end. AT&T has achieved 750 Mbps peak speed in San Francisco LTE-LAA field trial. AT&T said its SDN transformation is progressing, with more than 40 percent of network functions virtualized.

AT&T has kicked off 5G Evolution network in Austin and Indianapolis, reaching 20+ markets by year-end. AT&T has achieved 750 Mbps peak speed in San Francisco LTE-LAA field trial. AT&T said its SDN transformation is progressing, with more than 40 percent of network functions virtualized.

TBR, in an analyst note, said that AT&T will be disadvantaged by its late entry into the SD-WAN market as competitors including Verizon and CenturyLink have already begun to cement leading positions within the segment.

“Once again our team delivered expanded consolidated margins and, as a result, grew adjusted earnings per share by nearly 10 percent as we executed well against our business priorities,” said Randall Stephenson, chairman and CEO of AT&T.

Pricing pressures, smartphone saturation and stronger competition from OTT providers are creating obstacles for AT&T to grow its mobility and video businesses, which is spurring the carrier to become more reliant on bundles combining both services to improve its value proposition.

“AT&T’s profitability improved in the quarter, however, as operating margins rose 220 basis points year-to-year to 18.4 percent, aided by the company’s emphasis on non-subsidized wireless device plans,” said Steve Vachon, analyst at TBR.

AT&T trailed all of its competitors in postpaid phone net additions. The launch of its unlimited data plans helped to mitigate declines as the carrier’s postpaid phone losses improved in the quarter to -89,000, compared to -180,000 in Q2 2016.

DirecTV Now gained 152,000 customers. U-verse TV and DirecTV satellite businesses lost 351,000 subscribers in the second quarter. AT&T increased Video Entertainment revenue by 2.1 percent.

Business Solutions revenue decreased 2.7 percent due primarily to lower legacy voice and data revenue, AT&T is targeting growth from government customers.