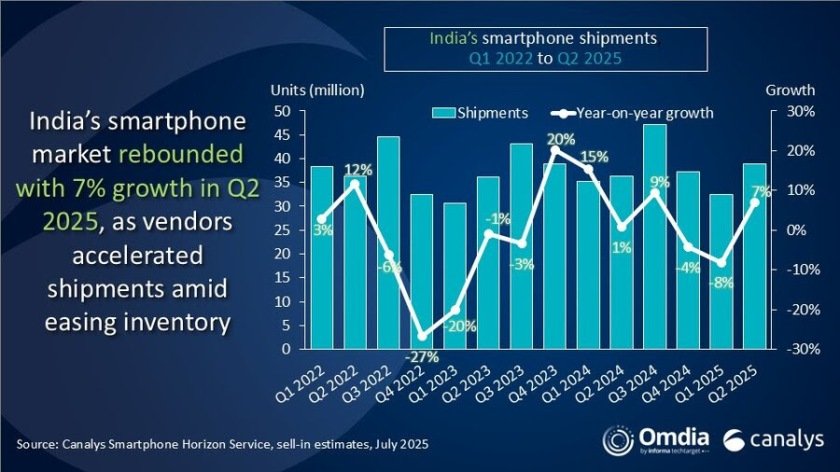

India’s smartphone market grew 7 percent in Q2 2025, reaching 39 million units, rebounding from a slow start to the year.

The recovery in India’s smartphone market was driven by new product launches and improved inventory conditions. Despite seasonal softness and challenges such as extreme weather, tariff tensions with the US, and geopolitical uncertainty, vendors resumed activity after a cautious Q1.

“Phone brands are locking inventory with distributors and retailers through channel incentive programs ahead of the upcoming festive season in India. These include rewards – ranging from foreign trips to vehicle rewards – tied to performance during Monsoon sales, Durga Puja and Diwali cycles,” Sanyam Chaurasia, Principal Analyst at Canalys, said.

“Retail infrastructure upgrades are gaining pace, with improved booth setups, structured shelf placements and stricter quarterly targets for promoter engagement and in-store execution,” Sanyam Chaurasia said.

Top vendors

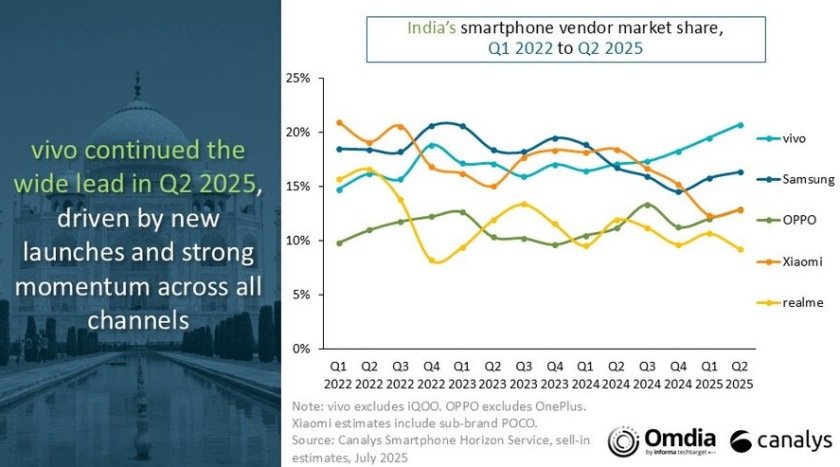

Vivo led the market with shipments of 8.1 million units and a 21 percent market share, up from 6.2 million and 17 percent share a year earlier.

Samsung maintained stable shipments at 6.2 million but saw a slight decline in market share from 17 percent to 16 percent.

OPPO grew from 4.1 million units and an 11 percent share to 5.0 million and 13 percent.

Xiaomi, in contrast, experienced a drop in shipments from 6.7 million to 5.0 million and a market share decline from 18 percent to 13 percent.

Realme also saw a decline in both shipments (from 4.3 million to 3.6 million) and market share (from 12 percent to 9 percent).

The “Others” category expanded to 11.0 million units and 28 percent share, up from 8.9 million and 25 percent, highlighting growing competition from smaller brands.

Growth strategy

Vivo focused on deepening retail partnerships and segment-specific product pushes, leveraging the success of the V50 series in urban centers through wedding-led campaigns and offline retail, while the Y-series and T-series expanded reach in smaller towns and online platforms respectively.

OPPO has strengthened its offline presence with the A5 series and gained online traction via the K13, helping it edge out competitors.

Samsung capitalized on its strong financing schemes to push mid-premium models like the A36 and A56, using long-tenure zero-cost EMIs to enhance accessibility and boost demand.

Xiaomi, despite a year-on-year decline, generated momentum with entry-level models like Redmi 14C 5G and A5, while refreshing its Note 14 series to regain visibility.

Realme, which also declined, focused on strengthening its offline push through the C73, C75, and 14X models, which together formed a significant portion of its shipment volume.

Apple maintained strong momentum with the iPhone 16 lineup driving over half of its shipments, while older models like the iPhone 15 and 13 sustained volume in multiple price segments; however, the iPhone 16e underperformed due to its perceived lack of value.

Motorola expanded beyond urban markets by extending retail networks into smaller cities, aiming for broader geographic penetration.

Infinix stood out within TRANSSION by embracing bold design and targeting niche communities such as gamers and content creators, becoming the group’s top-performing brand in India.

Nothing recorded exceptional growth by appealing to younger consumers through unique, design-forward products like the CMF Phone 2 Pro and Phone 3a series.

As phone vendors prepare for the second half of the year, their strategies are shifting toward enhanced channel execution, aggressive distributor incentives, upgraded retail infrastructure, and extended financing schemes, positioning them to optimize performance during India’s festive season despite lingering demand-side pressures.

Challenges

India’s smartphone vendors navigated a seasonally weak quarter marked by headwinds such as extreme weather, US tariff tensions, and geopolitical uncertainties. Elevated inventory levels from Q1 had initially led to cautious vendor activity, with growth only picking up later through aggressive new launches. Some vendors, including Xiaomi and realme, experienced year-on-year declines due to online softness and selective push strategies.

The market also saw intensified competition beyond the top five brands, with challengers like Infinix and Nothing gaining ground through niche targeting and design innovation. Apple’s iPhone 16e underperformed due to skepticism over its features and design.

Looking ahead, limited organic demand will force vendors to depend more on channel execution, with heavy reliance on incentives and retail infrastructure enhancements. However, Canalys (now part of Omdia) forecasts a modest full-year decline in shipments due to persistent structural challenges.

Baburajan Kizhakedath