During the three months ended June 28, 2025, Apple reported revenue of $94.036 billion – achieving sales growth in most product categories compared to $85.777 billion in the same period in 2024.

iPhone sales rose to $44.58 billion from $39.30 billion, reflecting strong demand. Mac revenue grew to $8.05 billion from $7.01 billion, while iPad revenue declined slightly to $6.58 billion from $7.16 billion. Revenue from Wearables, Home and Accessories decreased to $7.40 billion from $8.10 billion. Services continued to be a strong performer, generating $27.42 billion in revenue, up from $24.21 billion a year earlier.

Apple’s revenue grew across all geographic regions during the quarter. Revenue from the Americas increased to $41.20 billion from $37.68 billion, while Europe contributed $24.01 billion, up from $21.88 billion. In Greater China, revenue rose to $15.37 billion from $14.73 billion. Japan reported $5.78 billion, up from $5.10 billion, and revenue from the Rest of Asia Pacific increased to $7.67 billion from $6.39 billion.

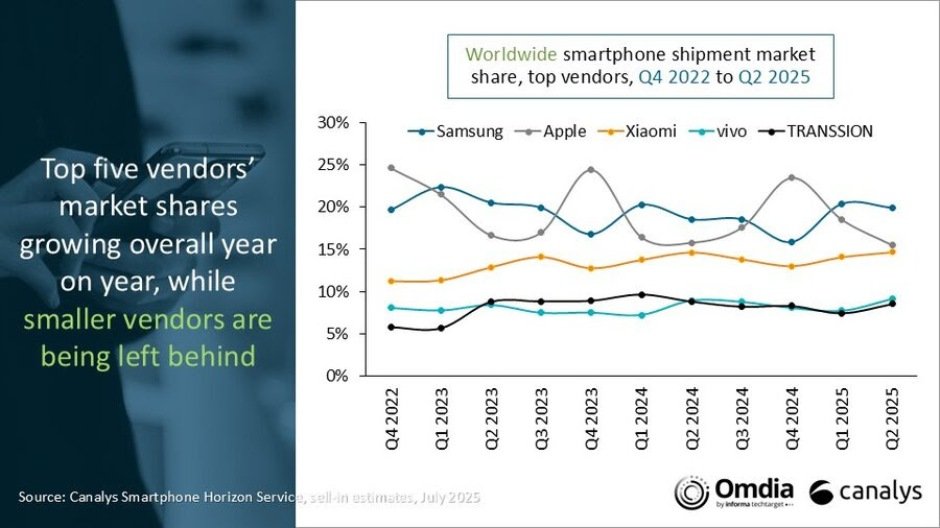

Canalys report indicated that Apple has secured the second position in the global smartphone market in Q2 2025 with 44.8 million iPhone shipments, marking a 2 percent decline year on year. Despite the drop, Apple demonstrated resilience amid intense competition in China and inventory adjustments in the US triggered by shifting tariff policies, Aaron West, Senior Analyst at Omdia, said.

Apple’s steady market presence reflects its strategic discipline in navigating global headwinds, though it faced pressure from vendors like Samsung, which gained significant ground through mass-market offerings.

While competitors accelerated regional plays in emerging markets and leaned on flexible financing options, Apple maintained its focus on premium positioning and long-term brand strength. The company’s performance signals a cautious but stable approach, balancing short-term shipment pressures with enduring brand loyalty and strategic alignment for future product cycles.

The latest IDC report said Apple experienced global growth of 1.5 percent in smartphone shipments to 46.4 million during Q2 2025, driven by strong double-digit gains in emerging markets. Despite being the top-performing brand during China’s 618 e-commerce festival, Apple saw a 1 percent year-over-year decline in shipments within China, as promotional efforts focused on inventory clearance rather than boosting new sales.

Macroeconomic challenges, including tariff volatility and inflation, impacted consumer spending across regions, particularly in the low-end Android segment, while Apple’s performance was sustained by its premium market presence and growing demand in developing regions, Nabila Popal, senior research director for Worldwide Client Devices, IDC, said.

AI

Apple is increasing its focus on artificial intelligence as part of its long-term strategy, despite investor concerns about the pace of AI integration into its products compared to rivals like Microsoft, Google, and Nvidia.

CEO Tim Cook acknowledged the delay in launching an AI-enhanced Siri but confirmed the company is making solid progress on a more personalized version. He emphasized that Apple is significantly growing its AI investments, though without the massive capital expenditures seen from competitors, Reuters news report said.

Tim Cook reiterated that Apple’s AI approach centers on making advanced technology intuitive and accessible. In Greater China, Apple experienced delays in AI feature approvals, but sales still rose above expectations.

While Apple’s stock has underperformed in 2025, partly due to tariff-related uncertainties and AI-related skepticism, Tim Cook’s comments suggest Apple is positioning itself to catch up in the AI race by aligning innovation with its core philosophy of simplicity and user-friendliness.

Baburajan Kizhakedath