Global spending on tablets and Chromebooks is on an upward trajectory, supported by government-backed programs, consumer subsidies, and increased investments in education and ecosystem integration, Canalys report said.

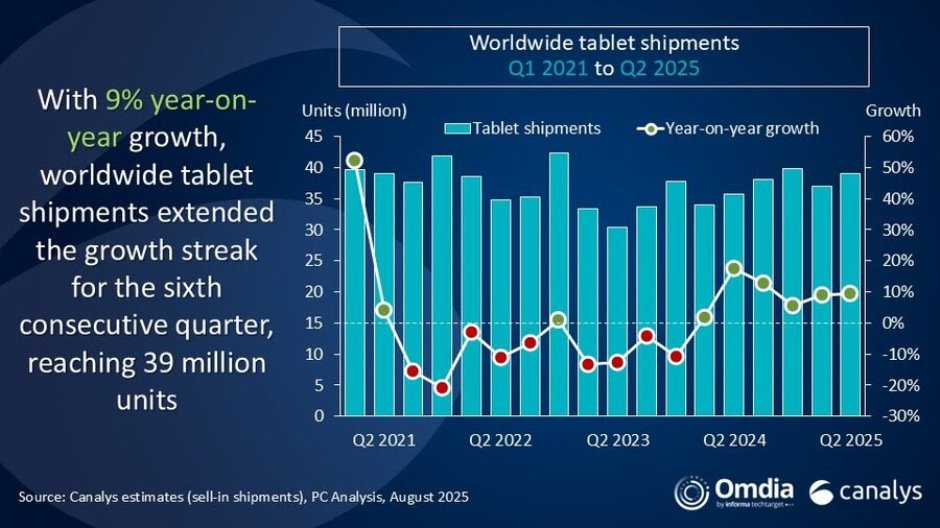

Tablet shipments rose 9 percent year-on-year in Q2 2025 to reach 39 million units, driven by strong demand in China and EMEA, along with new product launches targeting niche segments like gaming, Himani Mukka, Research Manager at Canalys, now part of Omdia, said.

Vendors are allocating more resources to product development and ecosystem strategies, with companies such as HONOR and Xiaomi positioning tablets as central devices in connected environments integrating phones, smart homes, and EVs. The Xiaomi Pad 7 Ultra exemplifies this push, serving as a hub within its “Human x Car x Home” strategy.

Apple maintained its lead with 14.1 million units shipped, a modest 2.4 percent increase from the previous year, although its market share dropped from 38.6 percent to 36.1 percent.

Samsung held second place with 6.7 million units, slightly down from 6.8 million in Q2 2024, leading to a decline in market share from 19.0 percent to 17.1 percent.

Huawei recorded significant growth, increasing shipments from 2.5 million to 3.2 million and expanding its market share from 7.0 percent to 8.3 percent.

Lenovo also experienced strong growth, with shipments rising from 2.5 million to 3.1 million and market share improving from 7.0 percent to 7.9 percent.

Xiaomi posted the largest growth among the top vendors, increasing shipments from 2.1 million to 3.1 million, boosting its market share from 6.0 percent to 7.8 percent.

The combined share of all other vendors remained relatively stable at 22.8 percent, up slightly from 22.5 percent the previous year.

Innovation is fueling growth across both tablets and Chromebooks. In the tablet segment, companies are introducing specialized devices like gaming tablets to capture emerging consumer preferences, especially in Asia.

New releases such as Xiaomi’s Redmi K Pad and Lenovo’s Legion Tab are gaining traction. Huawei and Xiaomi showed the most aggressive growth, at 29 percent and 42 percent respectively, supported by strong channel strategies and local demand.

Meanwhile, the Chromebook market is undergoing a revitalization, particularly due to Japan’s GIGA School Program. This initiative has triggered a surge in demand, with shipments to Japan growing more than twentyfold year-over-year. Continued investments in public-sector education technology across Asia will further bolster Chromebook sales.

Strategically, vendors are diversifying their focus by aligning device rollouts with broader digital transformation efforts. They are leveraging expos and education-focused campaigns to deepen market penetration, especially in countries prioritizing classroom digitization.

Manufacturers are also using these opportunities to build long-term customer ecosystems, viewing tablets not just as standalone products but as key control points for interconnected smart experiences. As a result, spending is shifting beyond basic hardware procurement to include bundled services, platform integration, and ecosystem engagement, setting the stage for sustained growth across both the tablet and Chromebook markets.