A report authored by Stefan Pongratz at Dell’Oro Group has revealed why telecom operators have slashed investments in Radio Access Network (RAN) in 2024 and the potential of RAN in 2025.

RAN in 2024

Telecom operators are reducing investments in the Radio Access Network (RAN) due to several interconnected factors

The 5G coverage, now reaching 55 percent of the global population, has slowed macro shipment deployments as the pace of coverage expansion decelerates.

This is compounded by a mismatch between supply and demand, as 5G’s mid-band deployments offer significant capacity boosts, reducing the immediate need for additional infrastructure investments.

Slower growth in mobile data traffic further diminishes urgency for capacity upgrades. Additionally, operators face challenges in monetizing 5G beyond traditional mobile broadband (MBB) use cases, making them cautious about investing heavily in new applications.

Regional downturns, particularly in large markets like China and India, have exacerbated the decline. Collectively, these issues have led to a sharp contraction in global RAN revenues, forcing operators to adopt a more conservative approach to capital expenditures.

RAN in 2025

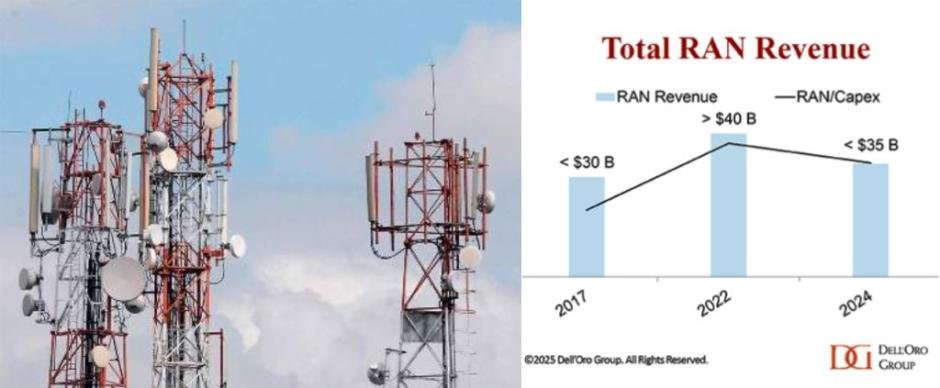

RAN conditions are expected to improve in 2025 after two years of sharp declines, during which global RAN revenues fell by approximately 20 percent compared to 2022. Global revenues are projected to stabilize and grow by 5 percent to 10 percent, excluding China.

Favorable regional variations, particularly improvements in India, Japan, and North America, will help offset the continued downward pressure caused by reduced 5G activity in China.

The private wireless RAN market is expected to see robust growth, with revenues forecasted to increase by over 20 percent in 2025. This growth will be driven by industrial adoption, with manufacturing retaining its leading position as the largest vertical.

Contract quality is improving, with deals increasingly moving beyond the proof-of-concept stage to include larger, multi-site, and multi-country agreements. Suppliers and operators are also bundling connectivity with additional services such as edge computing and applications, enhancing deal value and market reach.

Open RAN revenues, which faced a decline in 2024, are projected to recover and grow rapidly in 2025, contributing 8 percent to 10 percent of total RAN revenues. Although short-term challenges persist, the long-term trajectory for Open RAN remains strong as the commercial readiness of next-generation interfaces evolves.

Fixed wireless access (FWA) technologies will continue to play a significant role in addressing the connectivity needs of underserved households, secondary homes, and small businesses. With nearly half of 5G operators supporting FWA, this mature technology strengthens both the RAN and broadband markets.

While investments in dedicated FWA RAN solutions are expected to remain below $1 billion in 2025, the existing mobile network infrastructure will provide favorable economics for growth in this segment. These factors, combined with refined strategies from operators and suppliers, signal stabilization and potential growth for the RAN market in 2025.

Baburajan Kizhakedath